- Israel

- /

- Electronic Equipment and Components

- /

- TASE:SNCM

Middle Eastern Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As Gulf markets experience gains driven by progress in U.S. trade agreements, indices across the region, including Dubai and Saudi Arabia, have reached significant highs. In this context of market optimism and economic expansion, dividend stocks offer a compelling opportunity for investors seeking steady income streams amidst fluctuating conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.86% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.38% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.79% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.23% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.96% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.12% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.12% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.70% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.94% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.44% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

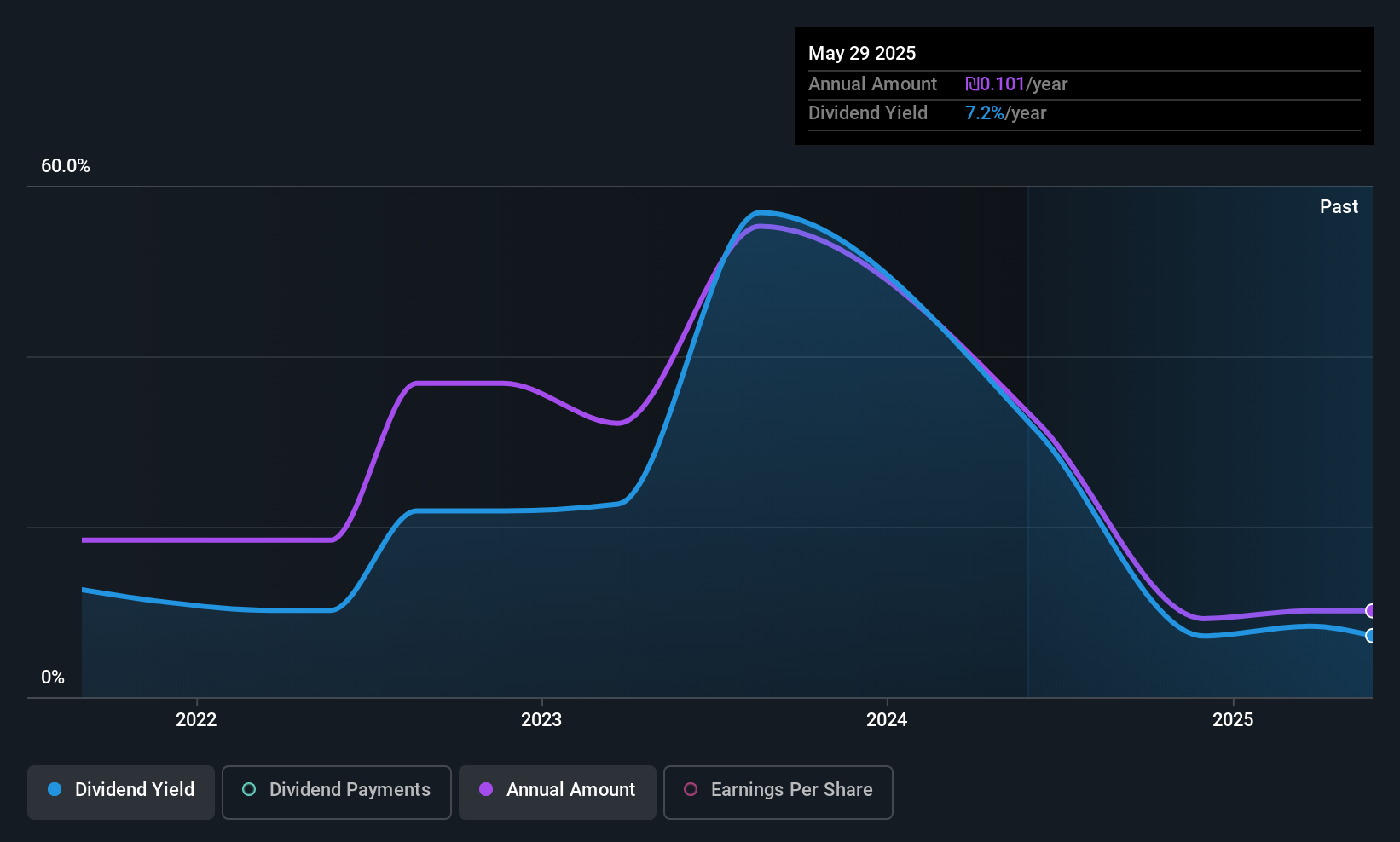

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.33 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from its Car and Other Related Services segment, amounting to AED589.90 million.

Dividend Yield: 5.5%

Emirates Driving Company P.J.S.C. offers a mixed dividend profile. While its dividend payments are covered by earnings and cash flows, the payout has been volatile over the past decade. Despite a 65.4% payout ratio, recent profit margins have declined significantly from last year. The company's dividend yield of 5.5% is below top-tier levels in the AE market but trades at good value relative to peers, with notable revenue growth reported recently (AED 167.11 million).

- Delve into the full analysis dividend report here for a deeper understanding of Emirates Driving Company P.J.S.C.

- Our valuation report unveils the possibility Emirates Driving Company P.J.S.C's shares may be trading at a discount.

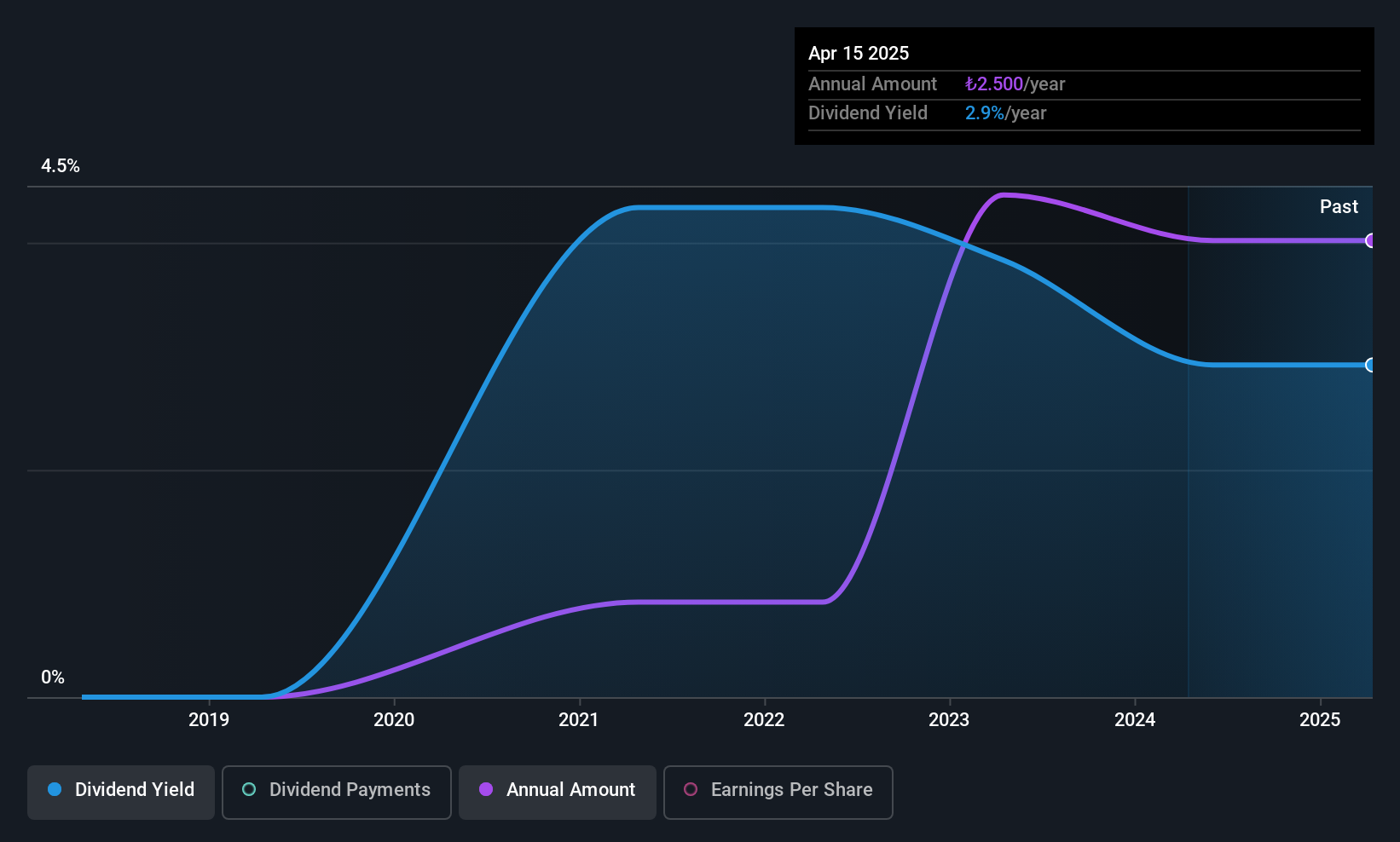

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri operates in the luxury fashion industry, focusing on textiles and ready-to-wear clothing, with a market capitalization of TRY8.99 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri generates revenue from its apparel segment, which amounts to TRY14.67 billion.

Dividend Yield: 4.4%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri presents a compelling dividend profile with a yield of 4.45%, placing it in the top 25% of Turkish dividend payers. The company's dividends are well-covered by both earnings and cash flows, with low payout ratios (18.5% and 21.8% respectively). Although dividends have grown over four years, they remain relatively new to investors seeking long-term stability. Recent earnings improvements reflect positive financial momentum despite a drop in sales revenue to TRY 3.49 billion.

- Unlock comprehensive insights into our analysis of Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri stock in this dividend report.

- Our valuation report unveils the possibility Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's shares may be trading at a premium.

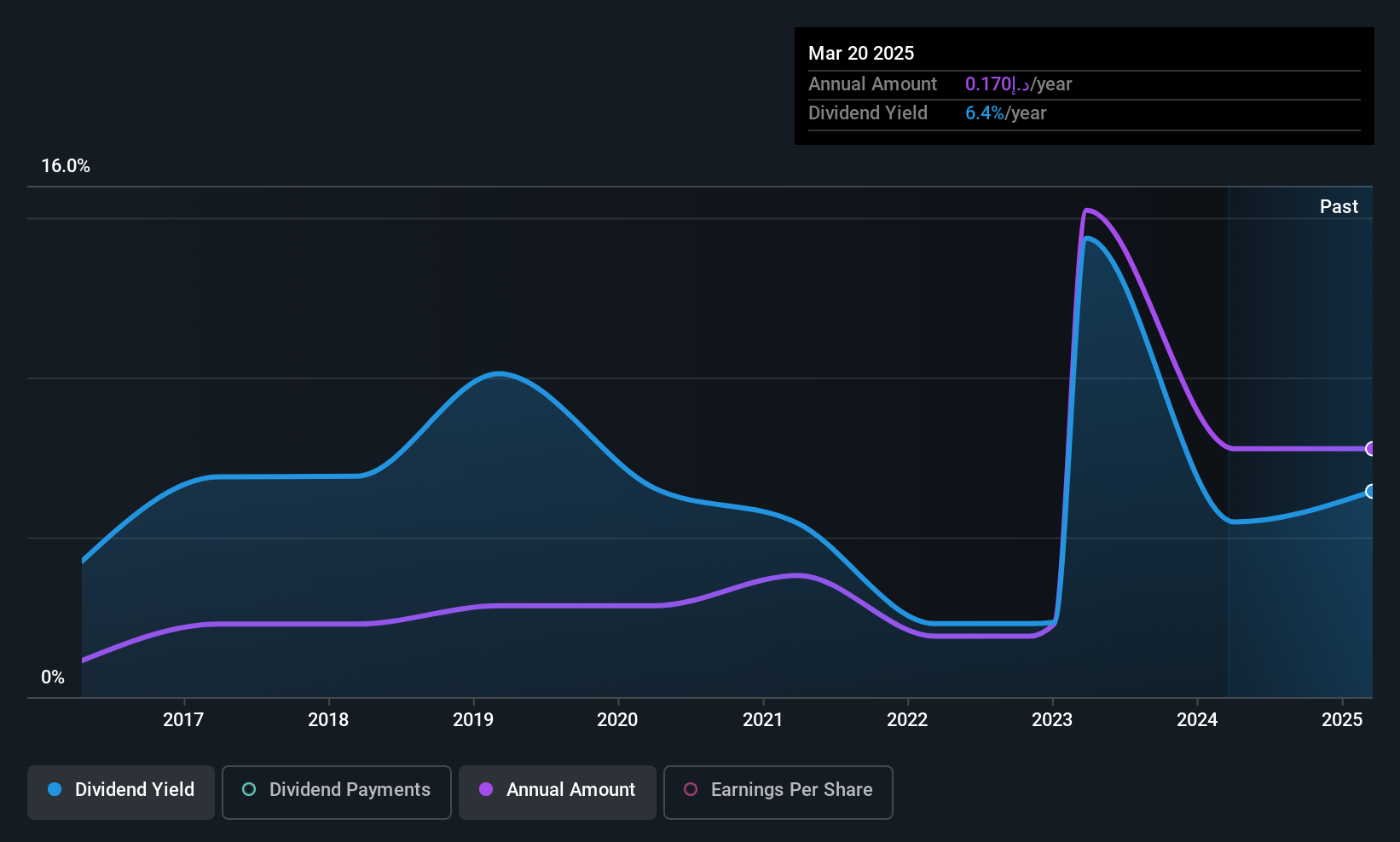

Suny Cellular Communication (TASE:SNCM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suny Cellular Communication Ltd operates in Israel by importing and marketing cell phones, accessories, and storage devices, with a market cap of ₪337.58 million.

Operations: Suny Cellular Communication Ltd generates revenue primarily from the sale of cellular phones and accessories, amounting to ₪1.02 billion.

Dividend Yield: 6.5%

Suny Cellular Communication offers a dividend yield of 6.52%, ranking in the top 25% of IL market payers, with dividends covered by earnings and cash flows at payout ratios of 78% and 59.1%, respectively. However, its dividend history is unstable, with payments declining over four years. Recent earnings showed a decrease to ILS 11.86 million from ILS 18.84 million year-over-year, indicating potential challenges despite trading slightly below estimated fair value.

- Navigate through the intricacies of Suny Cellular Communication with our comprehensive dividend report here.

- According our valuation report, there's an indication that Suny Cellular Communication's share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 75 Top Middle Eastern Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SNCM

Suny Cellular Communication

Engages in importing and marketing cell phones, accessories, and storage devices in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives