- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (MRK) Reports Decline in Q2 Earnings & Updates 2025 Sales Guidance

Reviewed by Simply Wall St

Merck (MRK) has recently reported a decline in both quarterly sales and net income, coupled with a narrowed sales guidance for 2025. Despite these announcements, the company's stock price moved up by 6% over the last month, suggesting investor sentiment may have been bolstered by other developments. Notably, the approval of KEYTRUDA® for cervical cancer by Health Canada and the initiation of the EXPrESSIVE Phase 3 Trials were key positive product-related news during this period. Additionally, broader market conditions were favorable, with major indices like the S&P 500 reaching record highs, which could have supported Merck's stock performance.

You should learn about the 1 weakness we've spotted with Merck.

The recent approvals and trials noted in the introduction could potentially offset the negative news surrounding Merck's sales and net income decline. These developments may boost the company's R&D credibility and future revenue streams. Analysts have been optimistic about Merck, with a consensus price target of US$101.79, which suggests a significant potential upside compared to the current share price of US$84.06. However, it's crucial to remain cautious due to the risks linked with KEYTRUDA's exclusivity loss and GARDASIL sales challenges.

Over the long term, Merck achieved a total return of 24.78% over five years, indicating strong performance. This is set against the backdrop of a challenging market environment, where Merck underperformed the S&P 500, which returned 17.7% over the past year, and the US Pharmaceuticals industry, which experienced a 6.8% decline in the same period. These figures highlight Merck's resilience, although it faces hurdles like international pricing pressures.

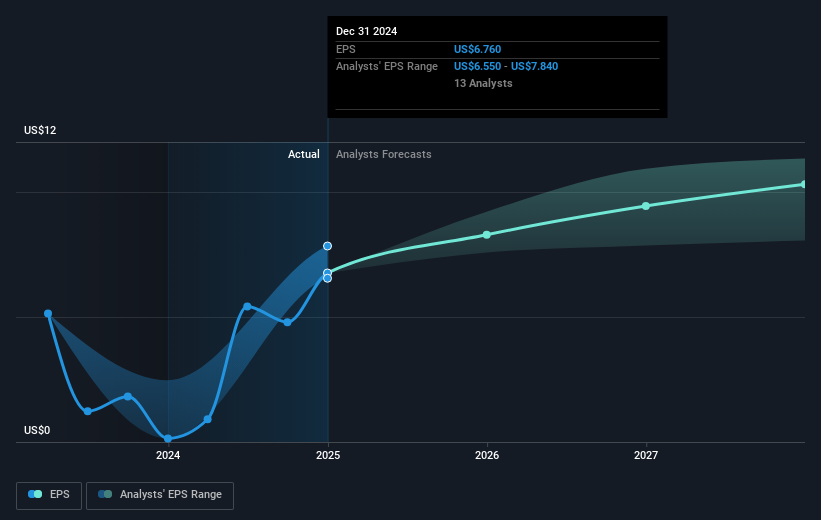

The recent news may influence revenue and earnings forecasts positively. Analysts expect a revenue growth rate of 4% annually over the next few years, with earnings projected to rise to US$24.3 billion by 2028. Nonetheless, the stock's current PE ratio of 12.1x, compared to the analyst forecasted PE of 12.3x in 2028, suggests room for growth, aligning with the analyst consensus that the stock has approximately 21.1% potential upside.

Understand Merck's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives