- Israel

- /

- Oil and Gas

- /

- TASE:RTPT

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi Leads 3 Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have shown a slight upward trend recently, despite concerns over a potential U.S. government shutdown impacting global financial conditions. In such fluctuating times, identifying promising investment opportunities requires careful consideration of companies' financial health and growth potential. Penny stocks, often representing smaller or newer firms, continue to attract investors due to their unique value propositions and growth possibilities when backed by solid fundamentals. This article explores three noteworthy penny stocks in the region that demonstrate robust financial strength and potential for future success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.81 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.75 | SAR1.5B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.984 | ₪354.91M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.03 | AED12.84B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.82 | AED498.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.76 | ₪216.66M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi operates in Turkey, specializing in the production and sale of foam sheets, with a market capitalization of TRY1.22 billion.

Operations: The company generates revenue from two main segments: Textile Operations, which contribute TRY13.41 billion, and Polyurethane Operations, accounting for TRY34.52 million.

Market Cap: TRY1.22B

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi has demonstrated substantial earnings growth, with a 270.9% increase over the past year, outpacing the Chemicals industry average. The company's debt management has improved, reducing its debt to equity ratio from 54.8% to 29.4% over five years, and its short-term assets exceed both short and long-term liabilities significantly. Despite high volatility in share price recently, Mega Polietilen's low price-to-earnings ratio (1.9x) suggests potential undervaluation compared to the broader Turkish market (22.7x). Recent earnings reports highlight strong sales growth and a transition from net loss to profitability year-over-year.

- Click here and access our complete financial health analysis report to understand the dynamics of Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi.

- Explore historical data to track Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's performance over time in our past results report.

Alarum Technologies (TASE:ALAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alarum Technologies Ltd. offers web data collection solutions across multiple regions globally, with a market cap of ₪354.91 million.

Operations: The company generates revenue primarily from its web data collection segment, amounting to $29.83 million.

Market Cap: ₪354.91M

Alarum Technologies Ltd. is experiencing notable earnings growth, with a 39.1% increase over the past year, though slightly below its five-year average of 41.5%. The company maintains strong financial health, as its debt is well covered by operating cash flow and it holds more cash than total debt. Despite recent volatility in share price and a low return on equity at 18.5%, Alarum's net profit margins have improved to 17.7% from last year's 12.4%. Recent earnings guidance projects significant revenue growth for the third quarter of 2025, indicating potential positive momentum despite prior sales declines.

- Click to explore a detailed breakdown of our findings in Alarum Technologies' financial health report.

- Assess Alarum Technologies' future earnings estimates with our detailed growth reports.

Ratio Petroleum Energy - Limited Partnership (TASE:RTPT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ratio Petroleum Energy - Limited Partnership focuses on the exploration, development, and production of oil and gas, with a market cap of ₪55.53 million.

Operations: Ratio Petroleum Energy - Limited Partnership has not reported any revenue segments.

Market Cap: ₪55.53M

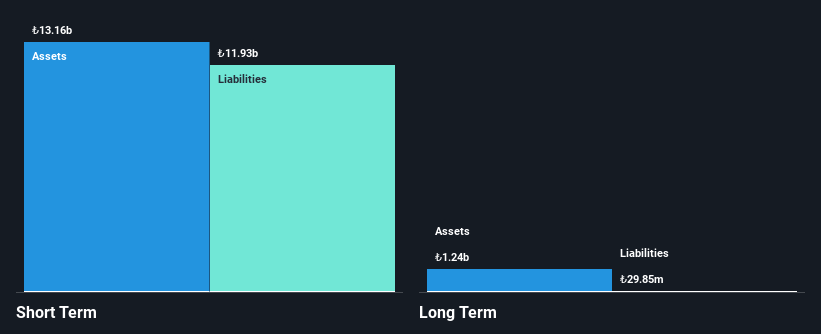

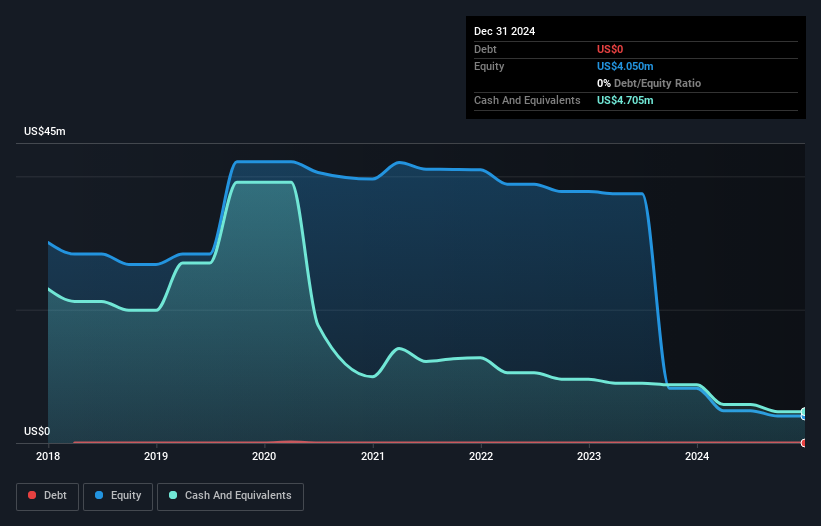

Ratio Petroleum Energy - Limited Partnership, with a market cap of ₪55.53 million, is pre-revenue and currently unprofitable. The company reported a net loss of US$0.461 million for the first half of 2025, an improvement from the previous year's loss of US$3.38 million. Despite its negative return on equity at -35.11%, Ratio Petroleum remains debt-free and has sufficient cash runway for over three years based on current free cash flow trends. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating financial stability despite ongoing losses in the oil and gas exploration sector.

- Get an in-depth perspective on Ratio Petroleum Energy - Limited Partnership's performance by reading our balance sheet health report here.

- Evaluate Ratio Petroleum Energy - Limited Partnership's historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 80 Middle Eastern Penny Stocks right here.

- Contemplating Other Strategies? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RTPT

Ratio Petroleum Energy - Limited Partnership

Engages in the exploration, development, and production of oil and gas.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives