- India

- /

- Diversified Financial

- /

- NSEI:JSWHL

Market Participants Recognise JSW Holdings Limited's (NSE:JSWHL) Earnings

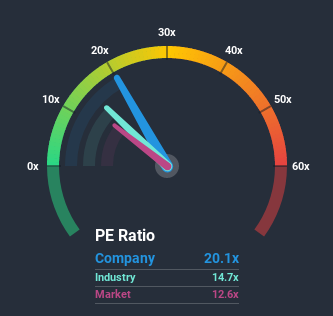

JSW Holdings Limited's (NSE:JSWHL) price-to-earnings (or "P/E") ratio of 20.1x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen at a steady rate over the last year for JSW Holdings, which is generally not a bad outcome. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for JSW Holdings

Does JSW Holdings Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within JSW Holdings' industry might provide some colour around the company's particularly high P/E ratio. The image below shows that the Capital Markets industry as a whole also has a P/E ratio higher than the market. So this goes some way towards explaining the company's ratio right now. In the context of the Capital Markets industry's current setting, most of its constituents' P/E's would be expected to be raised up. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

What Are Growth Metrics Telling Us About The High P/E?

JSW Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.4% last year. Pleasingly, EPS has also lifted 121% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to shrink 6.8% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we can see why JSW Holdings is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that JSW Holdings maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for JSW Holdings with six simple checks.

If you're unsure about the strength of JSW Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade JSW Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026