- United States

- /

- Luxury

- /

- NasdaqGS:LULU

lululemon athletica (NasdaqGS:LULU) Completes Share Buyback and Reports Q1 Earnings Growth

Reviewed by Simply Wall St

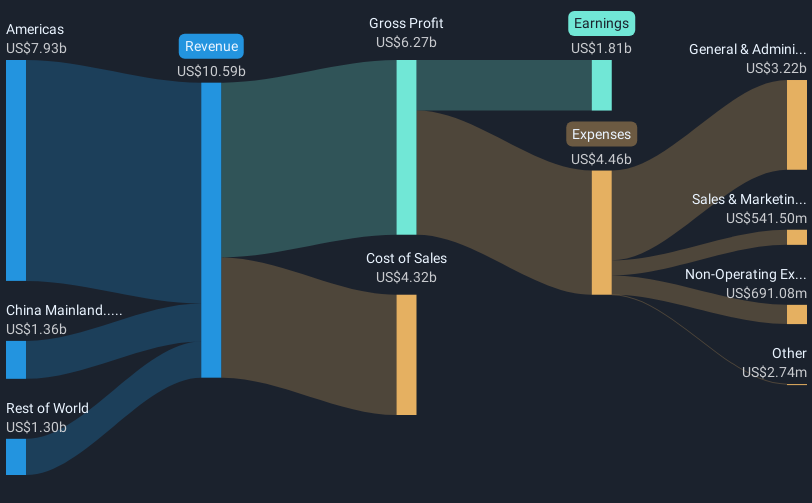

Lululemon athletica (NasdaqGS:LULU) recently announced its quarterly earnings results, revealing an increase in sales but a slight decrease in net income. The company's Q1 sales climbed to $2,370 million from $2,209 million year-over-year, though net income fell modestly to $315 million. Additionally, their updated 2025 earnings guidance projected a growth in annual revenue, yet a revision in full-year profit forecast led to an 18% dive in their stock price on announcement day. Despite a robust buyback program repurchasing over 1.5 million shares, the lowered EPS guidance could have contributed to contrasting the broader market's recent gains.

The recent announcement from Lululemon athletica of increased sales but decreased net income paints a mixed picture for investors, as evidenced by the significant 18% drop in stock price following the revised earnings guidance. This shift directly impacts the broader narrative of global expansion and product innovation driving growth. The implication is that despite ongoing efforts in new product lines and geographical market penetration, such projections raise concerns about potential challenges in achieving profitability targets. The lowered EPS guidance might weigh on revenue and earnings forecasts, tempering optimism despite an aggressive stock buyback initiative aimed at bolstering shareholder value.

Over the past three years, Lululemon's total shareholder return, including share price appreciation and dividends, stood at 9.42%. This provides context to the company's performance, showcasing positive movement over the longer term. Within the past year, Lululemon has exceeded the US Luxury industry, which experienced a 14.3% decline, yet underperformed compared to the broader market's 11% return. These figures highlight the challenges the company faces in maintaining its share price momentum and achieving industry-leading returns.

Furthermore, with a current share price significantly below the analyst consensus price target of US$332.59, recent price movements underscore investor concerns about near-term earnings potential. Analysts' forecasts suggest already pressured margins could see further compression, impacting future earnings and requiring a favorable shift in market conditions or stronger than anticipated growth to align with optimistic projections. The narrative of brand elevation through expanded offerings and physical footprint remains, but the recent financial results and market reactions bring scrutinized focus to execution risks and market volatility.

Learn about lululemon athletica's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives