- United States

- /

- Communications

- /

- NasdaqCM:GNSS

LRAD (NASDAQ:LRAD) Shareholders Booked A 63% Gain In The Last Three Years

It might be of some concern to shareholders to see the LRAD Corporation (NASDAQ:LRAD) share price down 13% in the last month. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. To wit, the share price did better than an index fund, climbing 63% during that period.

Check out our latest analysis for LRAD

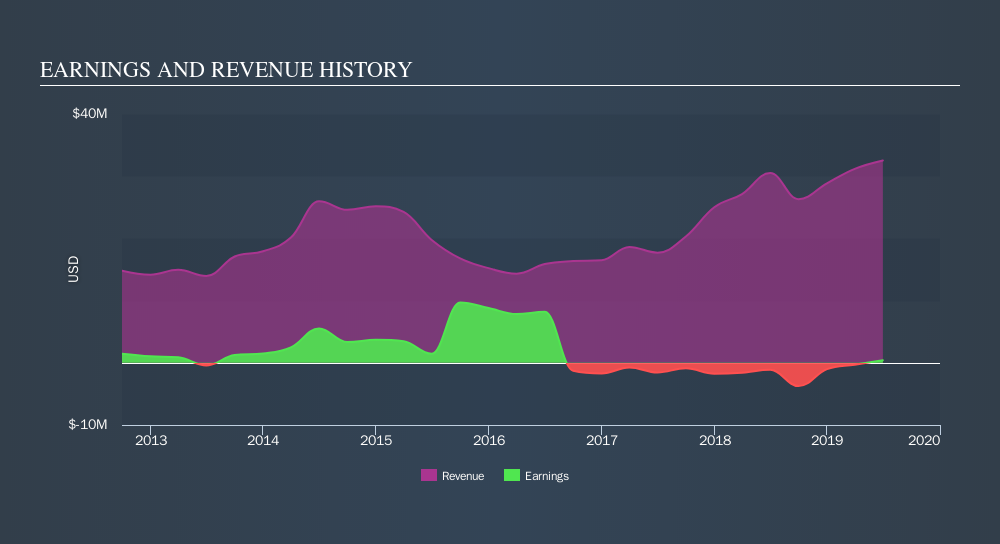

Given that LRAD only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years LRAD has grown its revenue at 26% annually. That's much better than most loss-making companies. The share price rise of 18% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at LRAD. If the company is trending towards profitability then it could be very interesting.

The image below shows how revenue has tracked over time.

We know that LRAD has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on LRAD

A Different Perspective

We're pleased to report that LRAD shareholders have received a total shareholder return of 4.6% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 2.9% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:GNSS

Genasys

Engages in the designing, developing, and commercializing of critical communications hardware and software solutions to alert, inform, and protect people principally in Asia Pacific, North and South America, Europe, the Middle East, and Africa.

Low with limited growth.

Similar Companies

Market Insights

Community Narratives