- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin (NYSE:LMT) Announces Breakthrough in C-130J Wing Structure Durability Testing

Reviewed by Simply Wall St

Lockheed Martin (NYSE:LMT) recently announced a major breakthrough in the wing structure testing of its C-130J aircraft, resulting in an enhanced wing life by nearly 40%. This achievement underscores the aircraft's reliability and reflects the company's commitment to innovation, likely supporting its stock's recent 2.35% increase over the past month. Meanwhile, the market faced volatility due to geopolitical tensions between Israel and Iran, and anticipation surrounding the Federal Reserve's interest rate decision. These factors contributed to the broader market fluctuations, with Lockheed Martin's advancements adding weight to its positive stock performance.

We've spotted 1 risk for Lockheed Martin you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent breakthrough in the wing structure of the C-130J aircraft could bolster Lockheed Martin's narrative of integrating advanced technologies like AI and 5G into its platforms, potentially enhancing operational capabilities and driving future contract wins. While the short-term stock increase of 2.35% reflects market optimism, it's important to examine the longer-term performance. Over the past five years, Lockheed Martin's total return, including dividends, was 47.69%. Despite this, the company's recent annual performance fell short of the US Aerospace & Defense industry, which saw a 34.9% return, indicating challenges in maintaining pace with industry peers.

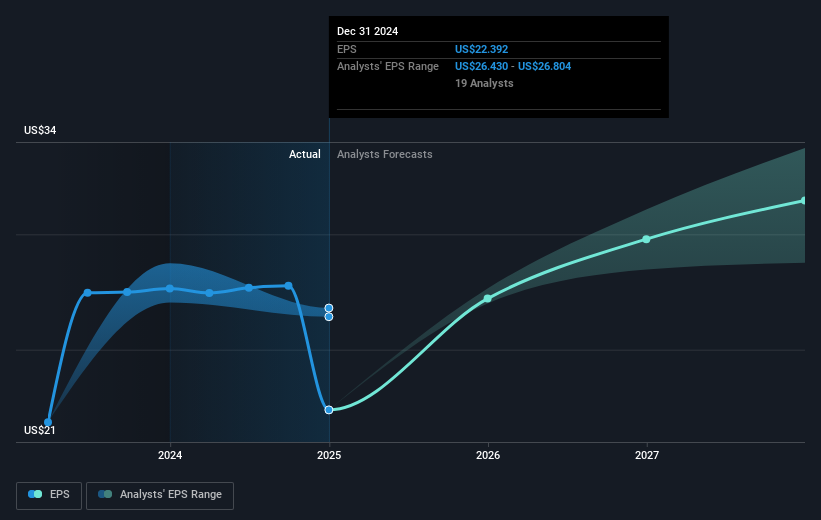

The company's revenue and earnings forecasts could be positively influenced by ongoing technological advancements and contract alignments with U.S. defense priorities. Analysts predict revenue growth of 3.8% annually, with earnings reaching US$7.2 billion by 2028. In light of the current share price of US$468.21 against a consensus price target of US$523.53, the recent technological advancements might contribute to closing this valuation gap, solidifying investor confidence in the company's future growth prospects.

Explore historical data to track Lockheed Martin's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives