- Australia

- /

- Professional Services

- /

- ASX:LNK

Link Administration Holdings Limited (ASX:LNK) Investors Are Less Pessimistic Than Expected

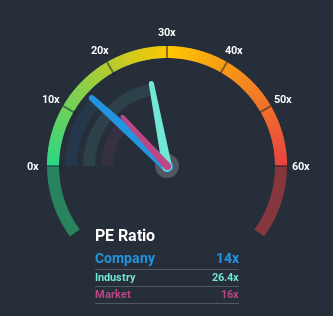

It's not a stretch to say that Link Administration Holdings Limited's (ASX:LNK) price-to-earnings (or "P/E") ratio of 14x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Link Administration Holdings' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Link Administration Holdings

Is There Some Growth For Link Administration Holdings?

The only time you'd be comfortable seeing a P/E like Link Administration Holdings' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 40%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 27% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 0.8% per annum over the next three years. With the market predicted to deliver 11% growth per year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Link Administration Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Link Administration Holdings' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Link Administration Holdings you should know about.

If you're unsure about the strength of Link Administration Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading Link Administration Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:LNK

Link Administration Holdings

Provides technology-enabled administration solutions for companies, large asset owners, and trustees worldwide.

Undervalued with concerning outlook.

Similar Companies

Market Insights

Community Narratives