- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (NasdaqGS:LIN) Expands CO2 Capacity In Texas With CHF 500M Debt Financing

Reviewed by Simply Wall St

Linde (NasdaqGS:LIN) announced plans to increase its CO2 production capacity and issued CHF 500 million in debt, aligning its expansion and sustainability goals with market trends. Despite these significant steps, the company’s share price rose by 5% over the past month, a move consistent with broader market gains, such as the S&P 500's strong performance. While major U.S. stock indexes rallied, supported by solid economic indicators like the favorable May jobs report, Linde's recent actions may have simply aligned with these broader positive market trends.

Linde has 2 risks we think you should know about.

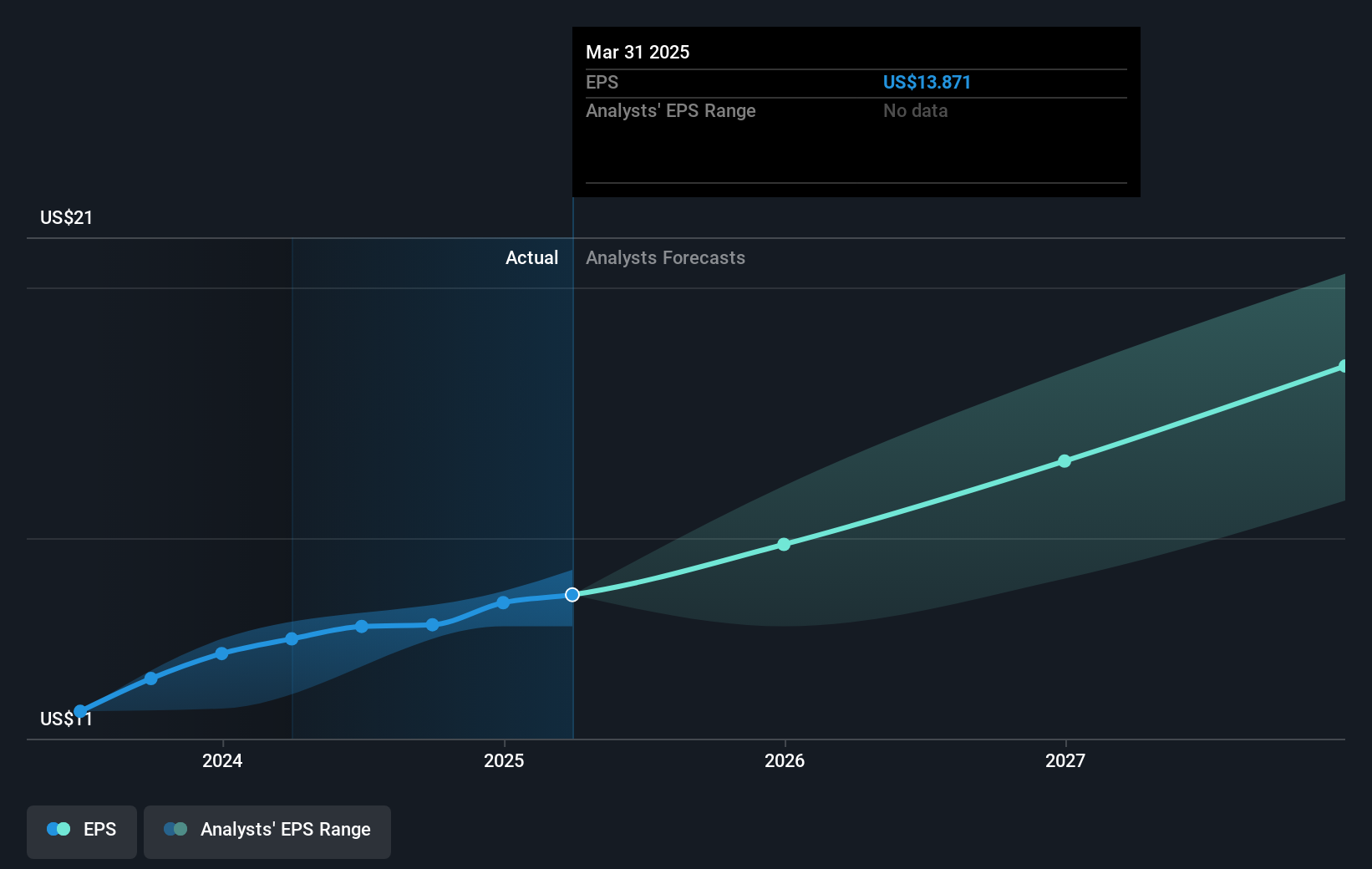

Linde's recent announcement to increase CO2 production capacity and issuance of CHF 500 million in debt aligns with its focus on sustainable growth and environmental initiatives. These actions are expected to support its revenue streams tied to clean energy projects. The CO2 capacity expansion may reinforce its market position, potentially impacting analysts' favorable revenue and earnings projections. However, broader economic uncertainties pose risks that could affect these forecasts.

Over the longer term, Linde's total return, including share price and dividends, reached over 153.22% throughout a five-year period. This reflects strong historical performance, albeit slightly underperforming the US market over the last year. Linde's earnings growth, albeit moderate recently, has consistently outpaced the chemical industry's average decline of 3.4%.

In context, Linde's recent stock price rise of 5% appears modest next to its past five-year performance. The current share price of US$447.05 remains below the analyst consensus price target of approximately US$491.57, highlighting potential for further growth if forecasts are met. With revenue anticipated to grow only at 4.8% annually, slower than the market average, the ongoing steps in sustainability might bridge the gap between current value and target projections in a complex economic landscape.

Evaluate Linde's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives