- France

- /

- Oil and Gas

- /

- ENXTPA:LHYFE

Lhyfe Leads The Charge In European Penny Stocks

Reviewed by Simply Wall St

The European market recently faced a downturn, with major stock indexes declining following the announcement of potential tariffs on EU goods by the U.S. President. Amidst this backdrop, investors are increasingly looking towards alternative investment opportunities that can offer resilience and growth potential. Penny stocks, despite their somewhat outdated name, represent smaller or newer companies that might provide surprising value when backed by solid financials. In this article, we explore three such penny stocks in Europe that combine strong balance sheets with promising prospects for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.315 | SEK2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.00 | SEK196.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.90 | €61.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.958 | €32.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.69 | €17.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €303.74M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lhyfe SA produces and supplies renewable green hydrogen for mobility and industry markets, with a market cap of €156.53 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to €5.10 million.

Market Cap: €156.53M

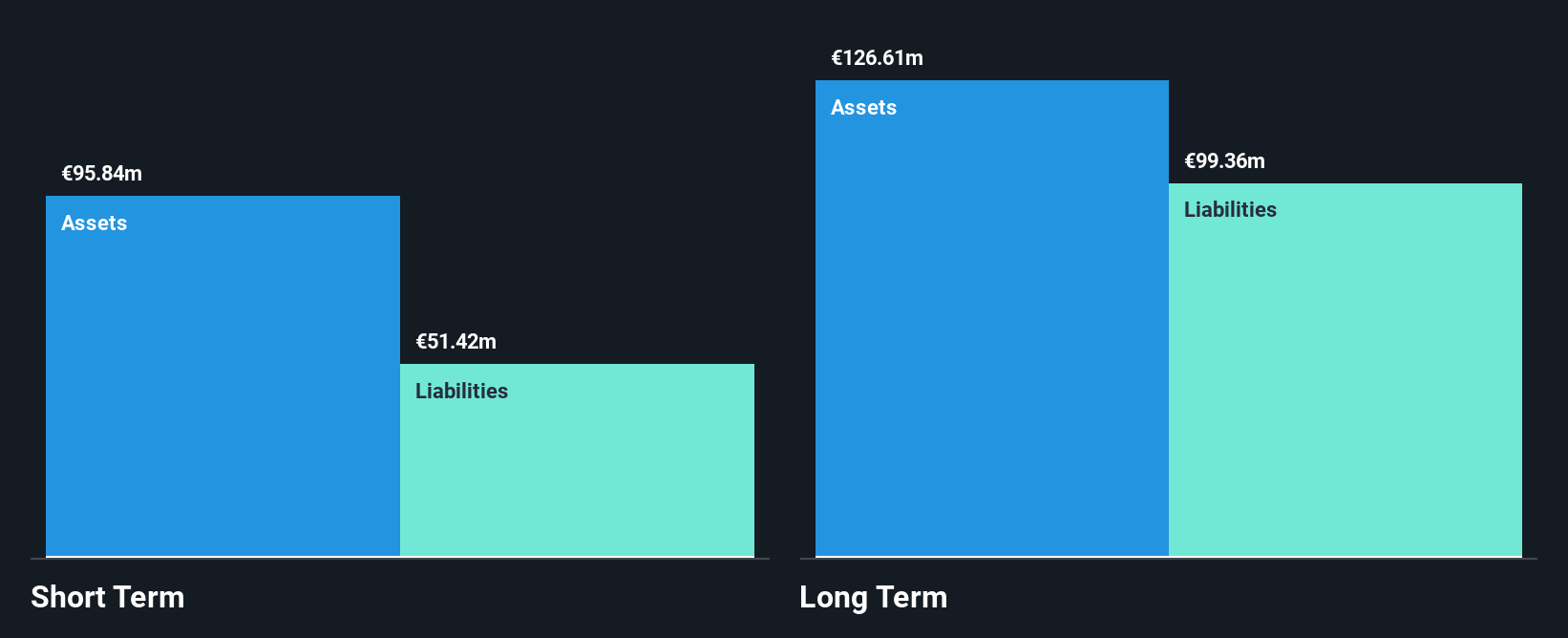

Lhyfe SA, with a market cap of €156.53 million, reported revenue of €5.10 million for the full year ending December 2024, reflecting growth from €1.32 million the previous year. Despite this increase in sales, Lhyfe remains unprofitable with a net loss of €29.09 million and a negative return on equity of -40.72%. The company's share price has been highly volatile over the past three months; however, shareholders have not faced significant dilution recently. While Lhyfe's short-term assets exceed its short-term liabilities, they do not cover long-term liabilities entirely. The company’s debt to equity ratio has improved over five years to 69.3%.

- Unlock comprehensive insights into our analysis of Lhyfe stock in this financial health report.

- Gain insights into Lhyfe's future direction by reviewing our growth report.

Nexam Chemical Holding (OM:NEXAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nexam Chemical Holding AB (publ) develops solutions to enhance the properties and performance of plastics across Sweden, Europe, and internationally, with a market cap of SEK301.01 million.

Operations: The company generates revenue primarily from its Performance Masterbatch segment, which accounts for SEK105.70 million.

Market Cap: SEK301.01M

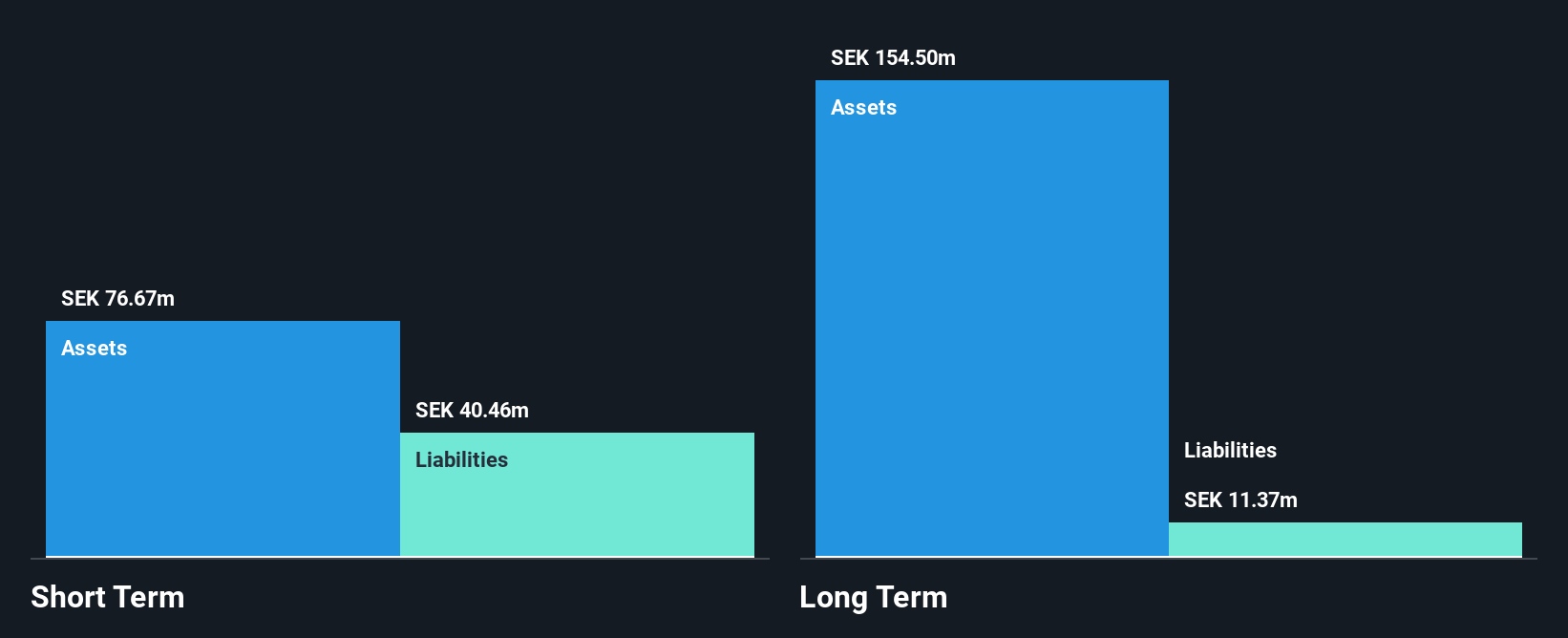

Nexam Chemical Holding AB, with a market cap of SEK301.01 million, primarily generates revenue from its Performance Masterbatch segment, reporting SEK49.41 million for Q1 2025. Despite this revenue stream, the company is unprofitable with increasing losses and a negative return on equity of -6.25%. Nexam's short-term assets exceed both its short- and long-term liabilities, reflecting some financial stability despite having less than a year of cash runway. Recent developments include participation in the TAPE-X project to innovate aerospace materials, potentially broadening industrial applications beyond civil aerospace due to enhanced processing capabilities and thermal resistance.

- Get an in-depth perspective on Nexam Chemical Holding's performance by reading our balance sheet health report here.

- Gain insights into Nexam Chemical Holding's outlook and expected performance with our report on the company's earnings estimates.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, trading under the ticker WSE:PRA, is a publicly owned investment manager with a market capitalization of PLN125.07 million.

Operations: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna has not reported any specific revenue segments.

Market Cap: PLN125.07M

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, with a market cap of PLN125.07 million, is pre-revenue and unprofitable but has managed to reduce losses by 69% annually over the past five years. The company is debt-free and maintains a cash runway exceeding three years despite recent earnings reports showing increased net losses for Q1 2025 compared to the previous year. Its short-term assets comfortably cover liabilities, although its highly volatile share price may concern potential investors. The board's inexperience could impact strategic decision-making as they navigate financial challenges without significant revenue streams.

- Take a closer look at Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's potential here in our financial health report.

- Review our historical performance report to gain insights into Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's track record.

Next Steps

- Get an in-depth perspective on all 445 European Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LHYFE

Lhyfe

Produces and supplies renewable green hydrogen for mobility and industry markets.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives