- Canada

- /

- Specialty Stores

- /

- TSX:LNF

Leon's Furniture Limited (TSE:LNF)'s Could Be A Buy For Its Upcoming Dividend

Leon's Furniture Limited (TSE:LNF) stock is about to trade ex-dividend in 4 days time. Ex-dividend means that investors that purchase the stock on or after the 6th of March will not receive this dividend, which will be paid on the 9th of April.

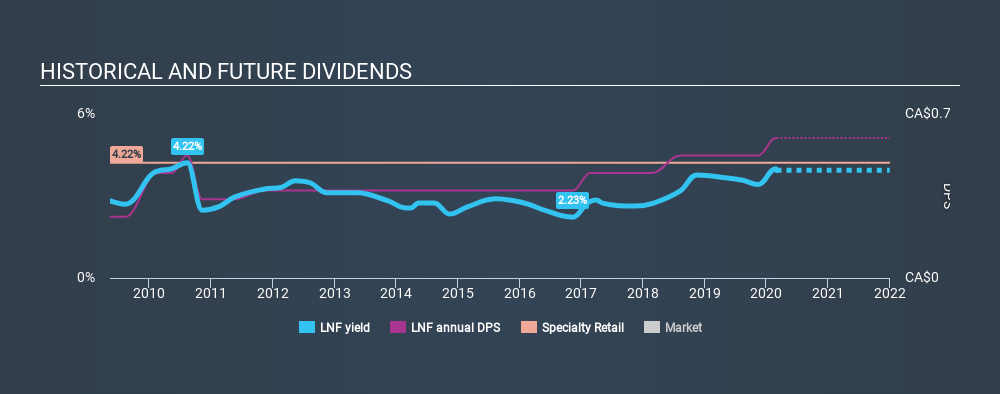

Leon's Furniture's next dividend payment will be CA$0.16 per share. Last year, in total, the company distributed CA$0.56 to shareholders. Calculating the last year's worth of payments shows that Leon's Furniture has a trailing yield of 3.9% on the current share price of CA$16.25. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Leon's Furniture

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Leon's Furniture paid out a comfortable 41% of its profit last year. A useful secondary check can be to evaluate whether Leon's Furniture generated enough free cash flow to afford its dividend. It paid out 22% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Leon's Furniture paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at Leon's Furniture, with earnings per share up 5.3% on average over the last five years. Management have been reinvested more than half of the company's earnings within the business, and the company has been able to grow earnings with this retained capital. Organisations that reinvest heavily in themselves typically get stronger over time, which can bring attractive benefits such as stronger earnings and dividends.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past ten years, Leon's Furniture has increased its dividend at approximately 8.6% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

The Bottom Line

Is Leon's Furniture an attractive dividend stock, or better left on the shelf? Earnings per share have been growing moderately, and Leon's Furniture is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. It might be nice to see earnings growing faster, but Leon's Furniture is being conservative with its dividend payouts and could still perform reasonably over the long run. There's a lot to like about Leon's Furniture, and we would prioritise taking a closer look at it.

Want to learn more about Leon's Furniture? Here's a visualisation of its historical rate of revenue and earnings growth.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:LNF

Leon's Furniture

Operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion