The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies LEG Immobilien AG (ETR:LEG) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for LEG Immobilien

What Is LEG Immobilien's Debt?

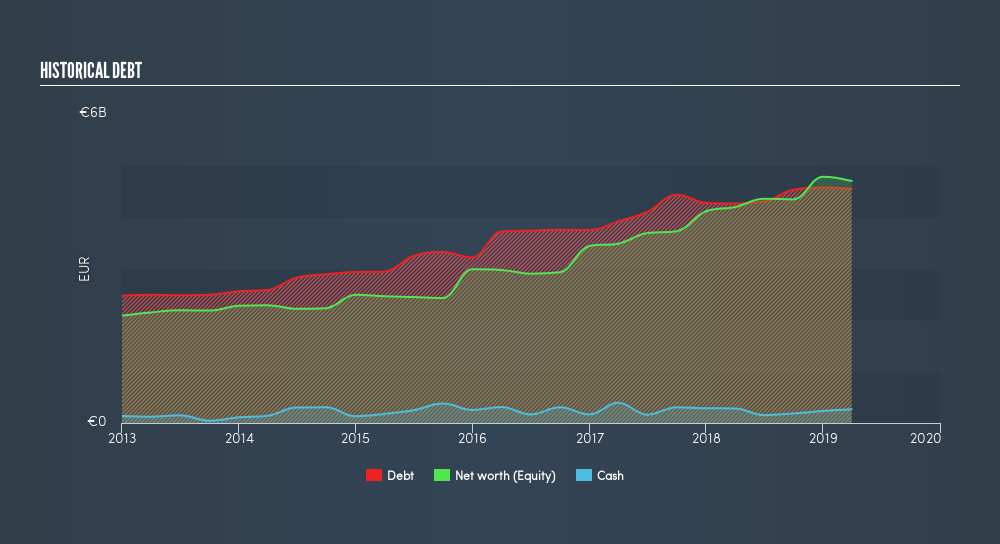

The image below, which you can click on for greater detail, shows that at March 2019 LEG Immobilien had debt of €4.63b, up from €4.29b in one year. On the flip side, it has €267.0m in cash leading to net debt of about €4.36b.

How Healthy Is LEG Immobilien's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that LEG Immobilien had liabilities of €977.6m due within 12 months and liabilities of €5.65b due beyond that. On the other hand, it had cash of €267.0m and €59.0m worth of receivables due within a year. So it has liabilities totalling €6.31b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €6.78b, so it does suggest shareholders should keep an eye on LEG Immobilien's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

LEG Immobilien has a rather high debt to EBITDA ratio of 10.5 which suggests a meaningful debt load. However, its interest coverage of 3.7 is reasonably strong, which is a good sign. Fortunately, LEG Immobilien grew its EBIT by 9.1% in the last year, slowly shrinking its debt relative to earnings. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine LEG Immobilien's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, LEG Immobilien recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

LEG Immobilien's struggle handle its debt, based on its EBITDA, had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its conversion of EBIT to free cash flow was refreshing. Taking the abovementioned factors together we do think LEG Immobilien's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check LEG Immobilien's dividend history, without delay!

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:LEG

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives