- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (LNTH) Announces US$400 Million Buyback Amid FDA and Earnings Updates

Reviewed by Simply Wall St

Lantheus Holdings (LNTH) recently unveiled a $400 million share repurchase program and reported second-quarter financials with a net income increase but a decline in sales year-over-year. Despite these developments, the company's stock declined by 28% last week. This sharp decrease could be attributed to lowered revenue guidance, falling sales figures, and concurrent market anxiety over tariffs and economic health, contrasting with the S&P 500's modest gain spurred by strong earnings reports from tech giants like Apple. Lantheus's significant price move highlights its challenges in aligning with broader market optimism.

We've identified 2 warning signs for Lantheus Holdings that you should be aware of.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

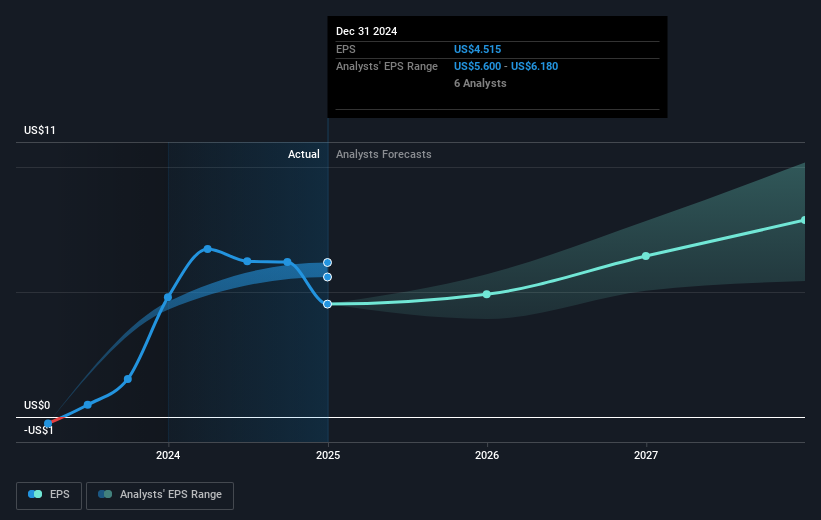

The recent announcement of a $400 million share repurchase program by Lantheus Holdings and the increase in second-quarter net income reflect the company’s efforts toward enhancing shareholder value and profitability. However, the decline in Lantheus's stock by 28% last week demonstrates investor concerns due to lowered revenue guidance and falling sales. These issues could influence the company's trajectory in the Alzheimer's diagnostics market and the wider radiopharmaceutical diagnostics sector. Analysts anticipate that strategic transactions and market expansion could drive revenue growth, yet the immediate market reaction illustrates skepticism regarding these projections. This skepticism extends into forecasts as well, with revenue and earnings expectations potentially needing adjustment if current conditions persist.

Over the past five years, Lantheus has delivered a remarkable total return of 283.37%, significantly outperforming recent market comparisons. Despite last year’s underperformance relative to the US Medical Equipment industry and the broader US market, Lantheus has demonstrated immense long-term value creation. The company’s projected revenue growth of 8.2% annually, though below the US market average, is coupled with an earnings growth forecast of 16.4% per year. While this contributes to analysts setting a fair value price target as high as US$124.29, the current share price of US$51.87 suggests a considerable discount. This discrepancy highlights potential room for appreciation, contingent on successfully overcoming present challenges and achieving projected growth milestones.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives