- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR (NYSE:KKR) Expands Japan Portfolio With Six New Prime Tokyo Properties

Reviewed by Simply Wall St

KKR (NYSE:KKR) recently signed agreements to acquire six prime properties in Tokyo, enhancing its footprint under the Weave Living Japan Residential Venture I partnership. This expansion aligns with KKR's broader strategy in Asia's real estate sector. The company's stock saw an 8% price increase over the last quarter, likely buoyed by its strategic growth initiatives and market sentiment that favored stocks amid easing U.S.-China trade tensions and encouraging inflation data. Positive developments in U.S. equities, including a supportive market backdrop, may have further influenced KKR's upward trajectory, despite challenges presented by a class action lawsuit and earnings net loss.

We've identified 2 risks for KKR that you should be aware of.

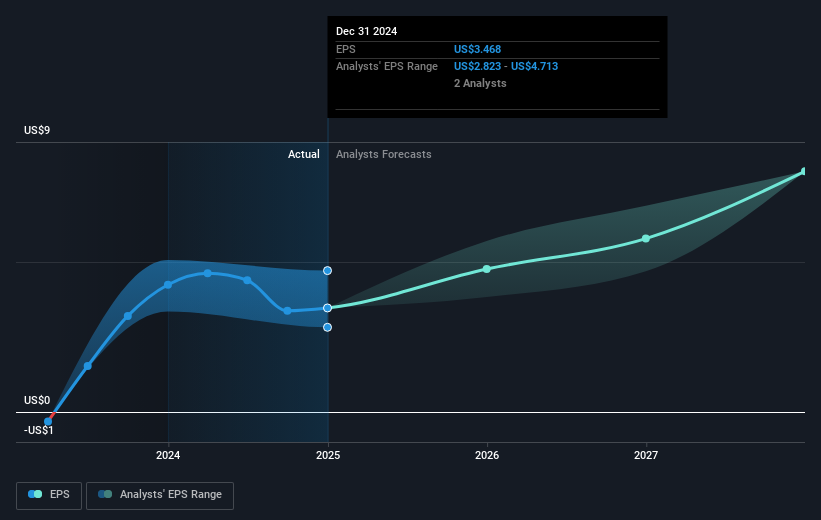

The recent acquisition of prime properties in Tokyo under the Weave Living Japan Residential Venture I partnership could bolster KKR's real estate strategy in Asia and enhance its revenue and earnings potential. This move may provide a diversified income stream, aligning with the company's aim to strengthen its pipeline in private wealth management, even as macroeconomic factors remain uncertain. The deal could be a pivotal factor considering analysts had earlier projected a 14% annual revenue decline over the next three years; the new assets might mitigate this forecasted dip.

Over the past five years, KKR's total shareholder return, inclusive of dividends, has been robust, exceeding threefold growth at a significant 324.76%. This growth marks a stark contrast to its recent one-year performance, where it underperformed relative to the US Capital Markets industry, which saw a 28.3% increase. Furthermore, KKR's share price currently trades at US$113.65, positioned below the consensus analyst price target of US$139.30. Should the recent Tokyo acquisition and its subsequent integration into KKR's portfolio prove lucrative, it could influence future earnings expectations and bring the share price closer to the anticipated target. The firm's strategic focus on partnerships and alternative investments may serve as a lever for long-term return enhancement despite present valuation concerns.

Our expertly prepared valuation report KKR implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives