Key Things To Understand About Agarwal Industrial's (NSE:AGARIND) CEO Pay Cheque

Jaiprakash Agarwal is the CEO of Agarwal Industrial Corporation Limited (NSE:AGARIND), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Agarwal Industrial.

Check out our latest analysis for Agarwal Industrial

Comparing Agarwal Industrial Corporation Limited's CEO Compensation With the industry

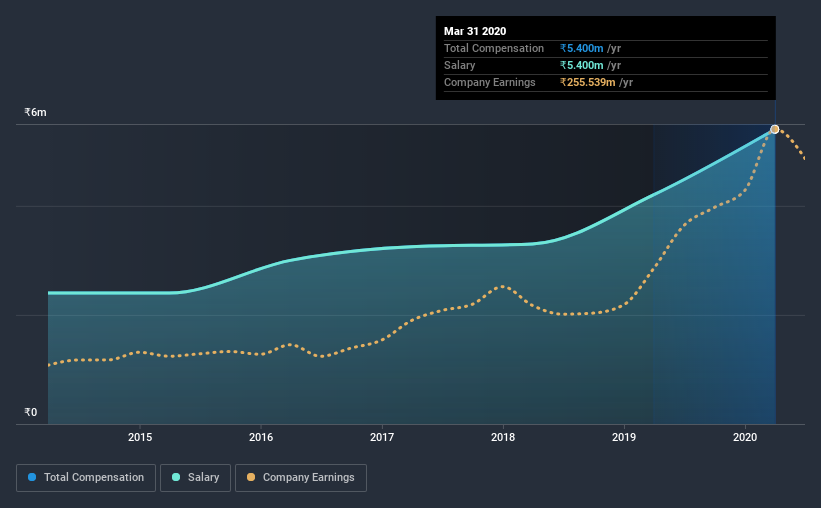

According to our data, Agarwal Industrial Corporation Limited has a market capitalization of ₹1.0b, and paid its CEO total annual compensation worth ₹5.4m over the year to March 2020. Notably, that's an increase of 29% over the year before. Notably, the salary of ₹5.4m is the entirety of the CEO compensation.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹6.0m. From this we gather that Jaiprakash Agarwal is paid around the median for CEOs in the industry. What's more, Jaiprakash Agarwal holds ₹78m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Speaking on an industry level, nearly 90% of total compensation represents salary, while the remainder of 10% is other remuneration. Speaking on a company level, Agarwal Industrial prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Agarwal Industrial Corporation Limited's Growth

Over the past three years, Agarwal Industrial Corporation Limited has seen its earnings per share (EPS) grow by 27% per year. It achieved revenue growth of 3.1% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Agarwal Industrial Corporation Limited Been A Good Investment?

Since shareholders would have lost about 84% over three years, some Agarwal Industrial Corporation Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Agarwal Industrial pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we noted earlier, Agarwal Industrial pays its CEO in line with similar-sized companies belonging to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Overall, we wouldn't say Jaiprakash is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 4 warning signs for Agarwal Industrial that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Agarwal Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:AGARIND

Agarwal Industrial

Manufactures and trades in petrochemicals in India and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.