Just 2 Days Before Indústrias Romi S.A. (BVMF:ROMI3) Will Be Trading Ex-Dividend

It looks like Indústrias Romi S.A. (BVMF:ROMI3) is about to go ex-dividend in the next 2 days. Ex-dividend means that investors that purchase the stock on or after the 23rd of June will not receive this dividend, which will be paid on the 16th of November.

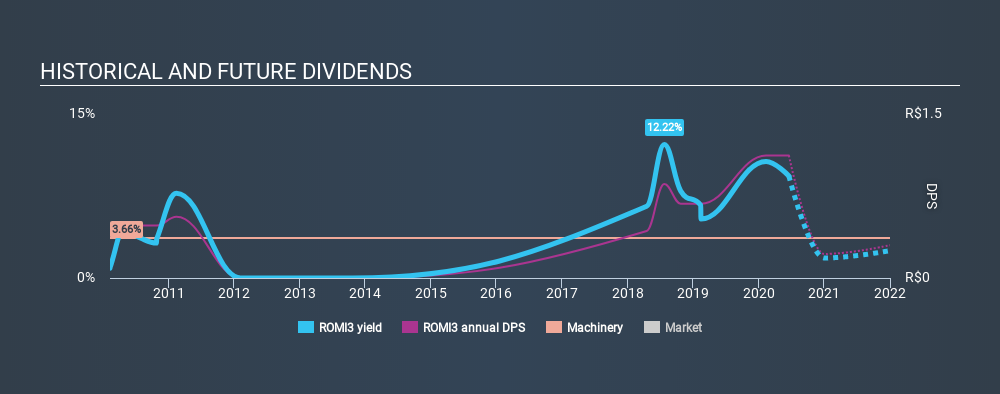

Indústrias Romi's upcoming dividend is R$0.085 a share, following on from the last 12 months, when the company distributed a total of R$1.12 per share to shareholders. Based on the last year's worth of payments, Indústrias Romi has a trailing yield of 8.8% on the current stock price of R$12.8. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Indústrias Romi has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Indústrias Romi

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Its dividend payout ratio is 87% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be concerned if earnings began to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out more than three-quarters (81%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see Indústrias Romi has grown its earnings rapidly, up 67% a year for the past five years. Earnings per share are growing at a rapid rate, yet the company is paying out more than three-quarters of its earnings.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, ten years ago, Indústrias Romi has lifted its dividend by approximately 24% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Is Indústrias Romi worth buying for its dividend? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. However, we'd also note that Indústrias Romi is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. To summarise, Indústrias Romi looks okay on this analysis, although it doesn't appear a stand-out opportunity.

So while Indústrias Romi looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. Every company has risks, and we've spotted 4 warning signs for Indústrias Romi you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BOVESPA:ROMI3

Romi

Develops, manufactures, and sells machine tools, plastic processing machines, and cast parts.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026