- United States

- /

- Biotech

- /

- NasdaqCM:ALDX

June 2025's Spotlight On Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally fueled by optimism over U.S.-China trade talks and robust corporate earnings, investors are increasingly exploring diverse investment opportunities. Penny stocks, a term that may seem outdated yet remains relevant, represent shares of smaller or newer companies that can offer significant growth potential when backed by strong financial health. In this article, we will explore several penny stocks that demonstrate balance sheet strength and long-term potential, providing investors with opportunities to uncover hidden value in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.02 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.935 | $29.35M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.475 | $533.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.06 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.11 | $186.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.815 | $184.86M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.86 | $22.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.32 | $54.64M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8311 | $6.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.43 | $76.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aldeyra Therapeutics (ALDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on discovering and developing therapies for immune-mediated and metabolic diseases, with a market cap of approximately $159.32 million.

Operations: Aldeyra Therapeutics, Inc. does not report any revenue segments.

Market Cap: $159.32M

Aldeyra Therapeutics, with a market cap of US$159.32 million, is a pre-revenue biotechnology firm navigating the challenging landscape of clinical trials and regulatory approvals. Despite recent setbacks from the FDA regarding its dry eye treatment candidate reproxalap, the company achieved significant milestones in Phase 3 trials that may address previous concerns. Financially, Aldeyra maintains strong short-term liquidity with US$92.7 million in assets against liabilities and has more cash than debt, providing a runway exceeding one year. However, high volatility and ongoing losses highlight inherent risks typical for companies at this developmental stage in the biotech sector.

- Unlock comprehensive insights into our analysis of Aldeyra Therapeutics stock in this financial health report.

- Explore Aldeyra Therapeutics' analyst forecasts in our growth report.

Maravai LifeSciences Holdings (MRVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maravai LifeSciences Holdings, Inc. is a life sciences company that offers products supporting the development of drug therapies, vaccines, cell and gene therapies, and diagnostics across various global regions with a market cap of $608.64 million.

Operations: The company generates revenue primarily from Nucleic Acid Production, which accounts for $179.08 million, and Biologics Safety Testing, contributing $62.78 million.

Market Cap: $608.64M

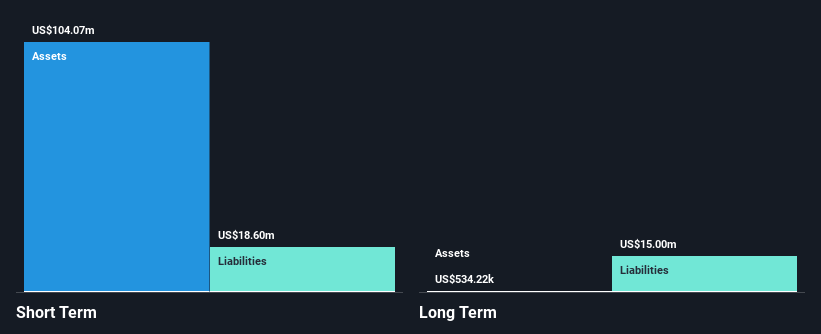

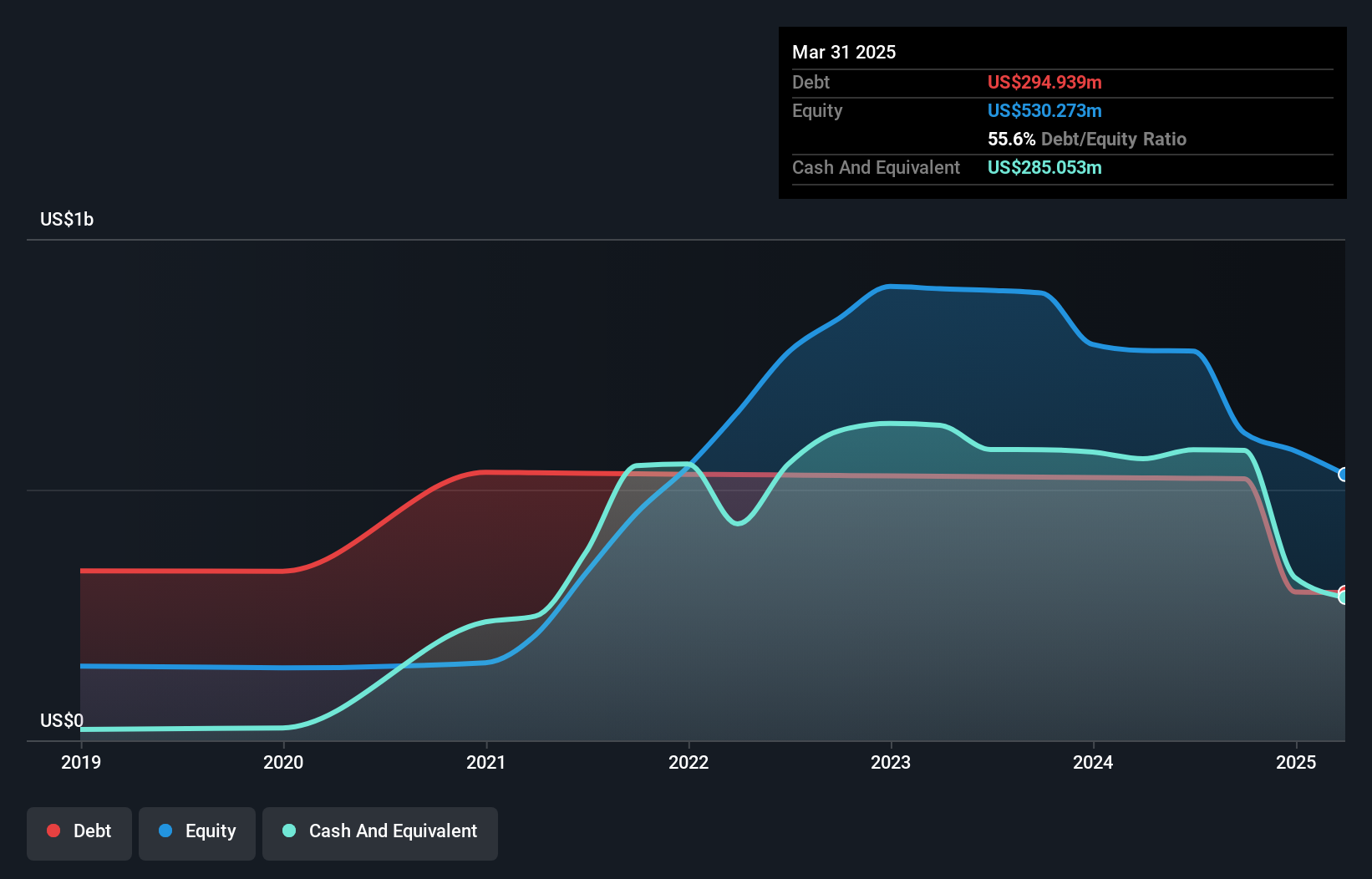

Maravai LifeSciences Holdings, with a market cap of US$608.64 million, faces challenges typical for penny stocks, including recent declines in sales and increased net losses. The company reported first-quarter sales of US$46.85 million, down from US$64.18 million a year prior, and a net loss of US$29.95 million compared to the previous year's US$12.08 million loss. Despite its unprofitability, Maravai has strong short-term liquidity with assets surpassing both short- and long-term liabilities and has reduced its debt-to-equity ratio over five years from 262.7% to 55.6%, indicating improved financial management amidst volatility concerns.

- Navigate through the intricacies of Maravai LifeSciences Holdings with our comprehensive balance sheet health report here.

- Assess Maravai LifeSciences Holdings' future earnings estimates with our detailed growth reports.

Ranpak Holdings (PACK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ranpak Holdings Corp. offers product protection and end-of-line automation solutions for e-commerce and industrial supply chains across North America, Europe, and Asia, with a market cap of approximately $306.61 million.

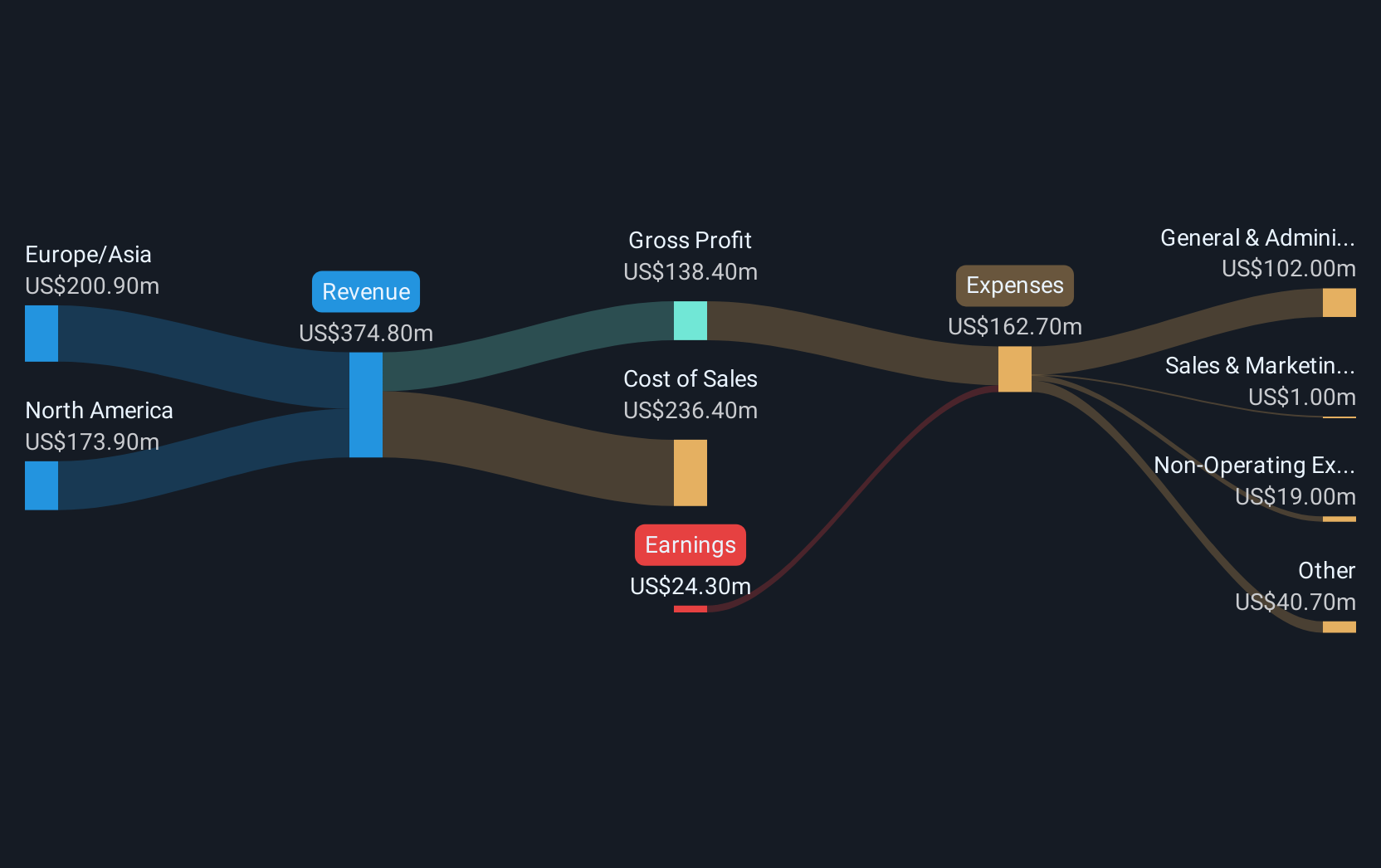

Operations: The company generates $374.8 million in revenue from its product protection and automation solutions for e-commerce and industrial supply chains.

Market Cap: $306.61M

Ranpak Holdings, with a market cap of US$306.61 million, exemplifies the volatility and potential of penny stocks. Despite being unprofitable with increasing losses over five years and a negative return on equity, Ranpak maintains a seasoned management team and board. The company reported first-quarter revenue growth to US$91.2 million but also faced a net loss of US$10.9 million. Recent strategic partnerships, like the one with Thalia for automated packaging systems, highlight its commitment to innovation in e-commerce fulfillment solutions while managing high debt levels and maintaining sufficient cash runway for over three years.

- Click to explore a detailed breakdown of our findings in Ranpak Holdings' financial health report.

- Understand Ranpak Holdings' earnings outlook by examining our growth report.

Key Takeaways

- Explore the 709 names from our US Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALDX

Aldeyra Therapeutics

A biotechnology company, discovers and develops therapies designed to treat immune-mediated and metabolic diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives