June 2025's Asian Market Stocks Possibly Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As tensions between the U.S. and China continue to influence global trade dynamics, Asian markets are experiencing a mix of challenges and opportunities, with Chinese stocks seeing a boost from anticipated government stimulus. In this environment, identifying stocks that may be trading below their estimated fair value can offer potential investment opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.24 | CN¥76.36 | 49.9% |

| Wanguo Gold Group (SEHK:3939) | HK$30.70 | HK$61.36 | 50% |

| Lucky Harvest (SZSE:002965) | CN¥41.05 | CN¥81.83 | 49.8% |

| Livero (TSE:9245) | ¥1700.00 | ¥3349.85 | 49.3% |

| Kanto Denka Kogyo (TSE:4047) | ¥838.00 | ¥1673.94 | 49.9% |

| IG Port (TSE:3791) | ¥1844.00 | ¥3631.34 | 49.2% |

| Food & Life Companies (TSE:3563) | ¥6515.00 | ¥13024.46 | 50% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.52 | CN¥52.32 | 49.3% |

| Elan (TSE:6099) | ¥851.00 | ¥1698.32 | 49.9% |

| Brangista (TSE:6176) | ¥596.00 | ¥1181.09 | 49.5% |

Here's a peek at a few of the choices from the screener.

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy and infrastructure sectors with a market cap of ₩14.73 trillion.

Operations: The company's revenue comes from three main segments: Shipbuilding & Marine Engineering, generating ₩9.50 trillion; Construction, contributing ₩752.33 billion; and Offshore and Energy Infrastructure activities worldwide.

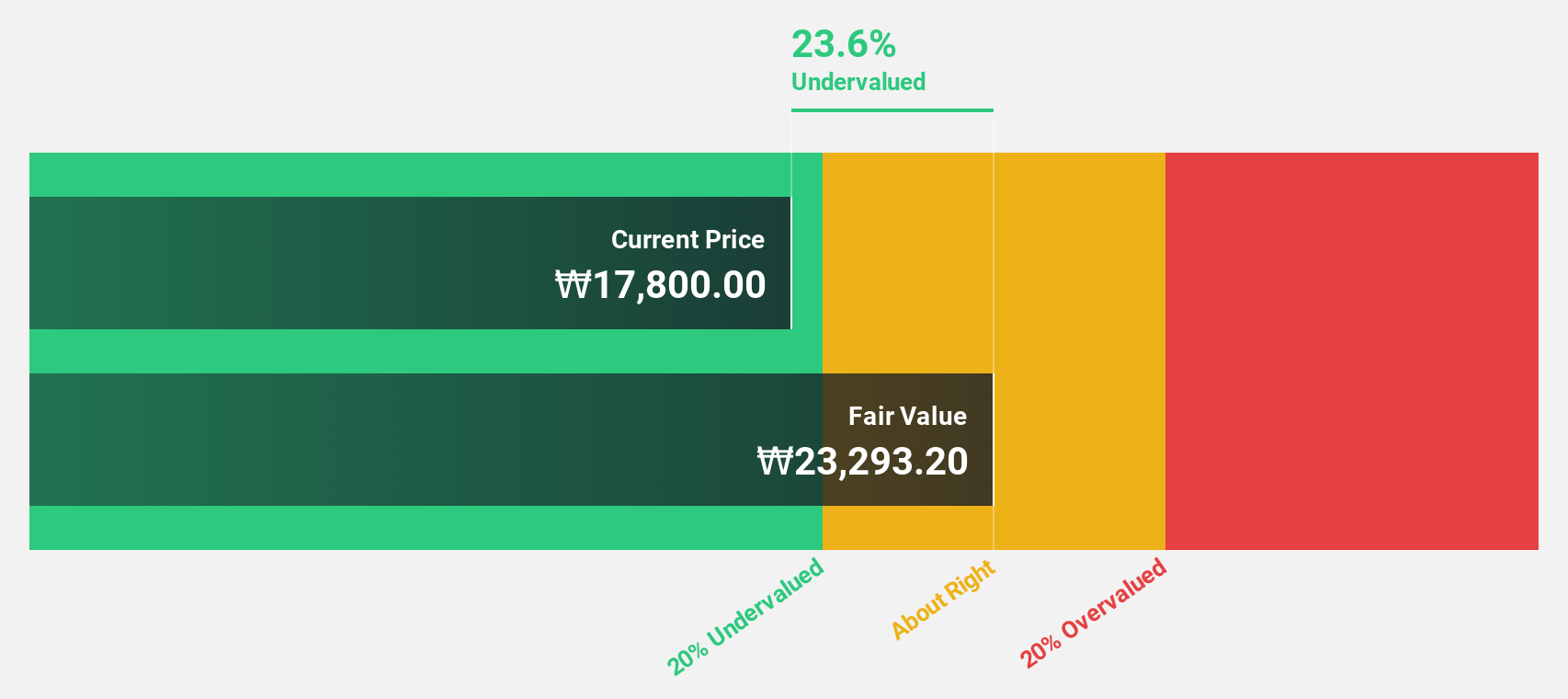

Estimated Discount To Fair Value: 25.6%

Samsung Heavy Industries is trading at 25.6% below its estimated fair value of ₩23,190.64, highlighting its undervaluation based on cash flows. Recent earnings reports show significant improvement, with Q1 2025 net income reaching KRW 92.10 billion compared to KRW 9.95 billion a year ago. While interest payments are not well covered by earnings and return on equity forecasts remain low, the company's annual profit growth is expected to outpace the market significantly at over 50%.

- Our expertly prepared growth report on Samsung Heavy Industries implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Samsung Heavy Industries.

Wanguo Gold Group (SEHK:3939)

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$33.27 billion.

Operations: The company's revenue is derived from two main segments: the Yifeng Project, contributing CN¥687.63 million, and the Solomon Project, generating CN¥1.19 billion.

Estimated Discount To Fair Value: 50%

Wanguo Gold Group is trading at HK$30.7, significantly below its fair value estimate of HK$61.36, indicating a strong undervaluation based on cash flows. Earnings grew 71.6% last year and are expected to rise 33.8% annually, outpacing the Hong Kong market's growth rate of 10.5%. Despite recent insider selling and past shareholder dilution, revenue is forecast to grow at an impressive 28.3% per year, with earnings projected to remain robust over the next three years.

- In light of our recent growth report, it seems possible that Wanguo Gold Group's financial performance will exceed current levels.

- Dive into the specifics of Wanguo Gold Group here with our thorough financial health report.

Guangdong Zhongsheng Pharmaceutical (SZSE:002317)

Overview: Guangdong Zhongsheng Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the research, development, production, and sale of various medicinal products with a market cap of CN¥14.25 billion.

Operations: Guangdong Zhongsheng Pharmaceutical Co., Ltd. generates revenue through its activities in the research, development, production, and sale of medicinal products within the pharmaceutical industry.

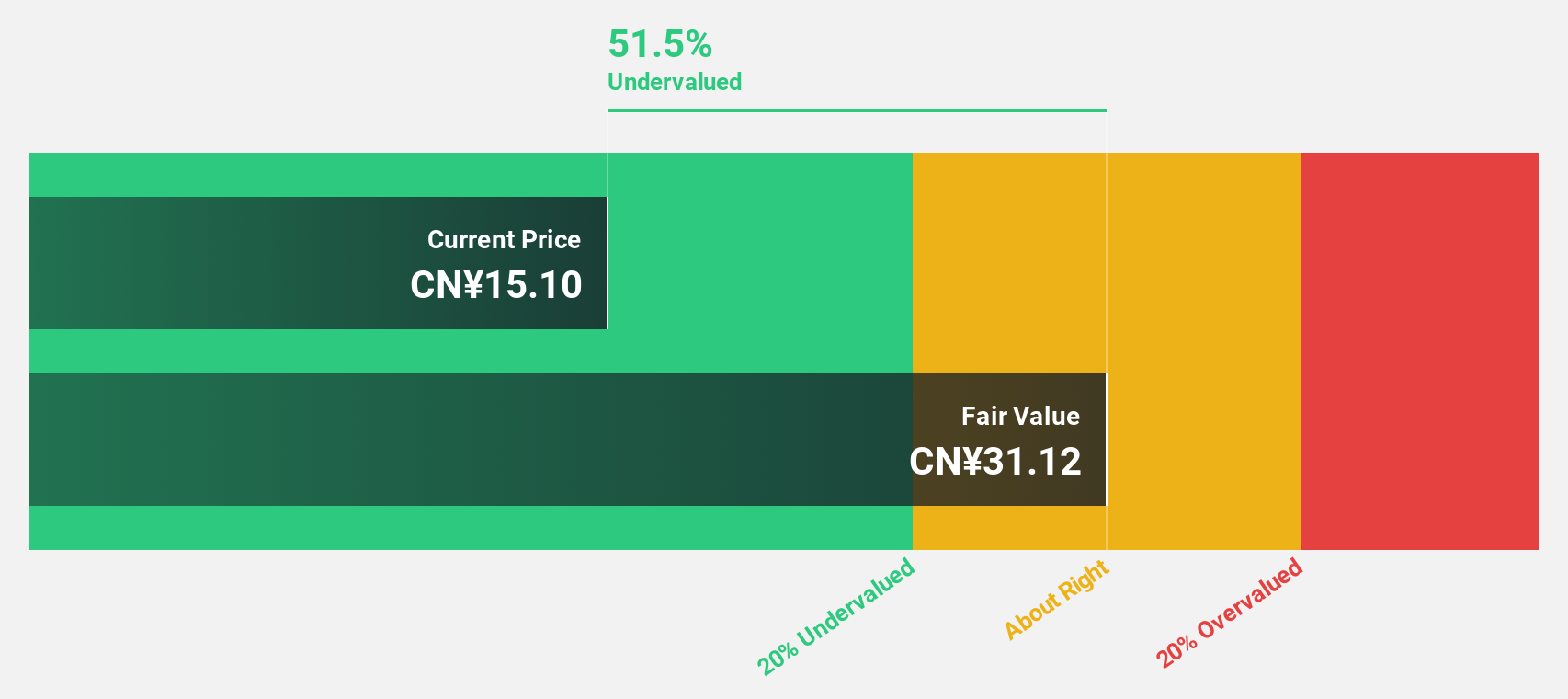

Estimated Discount To Fair Value: 45.9%

Guangdong Zhongsheng Pharmaceutical is trading at CN¥16.84, well below its estimated fair value of CN¥31.12, highlighting significant undervaluation based on cash flows. Despite a net loss of CNY 299.16 million in 2024, the company is forecast to achieve profitability within three years with revenue growth projected at 21.1% annually, surpassing the Chinese market's average growth rate of 12.4%. However, dividend sustainability remains questionable due to insufficient earnings coverage.

- The analysis detailed in our Guangdong Zhongsheng Pharmaceutical growth report hints at robust future financial performance.

- Navigate through the intricacies of Guangdong Zhongsheng Pharmaceutical with our comprehensive financial health report here.

Key Takeaways

- Gain an insight into the universe of 294 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002317

Guangdong Zhongsheng Pharmaceutical

Guangdong Zhongsheng Pharmaceutical Co., Ltd.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives