- United States

- /

- Machinery

- /

- NasdaqCM:MVST

June 2025 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The market has climbed 1.6% in the last 7 days and is up 12% over the last 12 months, with earnings forecast to grow by 14% annually. In such a robust environment, identifying stocks with strong financial fundamentals is crucial for investors seeking growth potential. Although 'penny stocks' might seem like an outdated term, these smaller or newer companies can offer compelling opportunities when they demonstrate balance sheet resilience and financial strength.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.02 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.935 | $29.35M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.475 | $533.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.06 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.11 | $186.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.815 | $184.86M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.86 | $22.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.32 | $54.64M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8311 | $6.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.43 | $76.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Microvast Holdings (MVST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. offers battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.28 billion.

Operations: The company's revenue is primarily derived from its Batteries / Battery Systems segment, which generated $414.94 million.

Market Cap: $1.28B

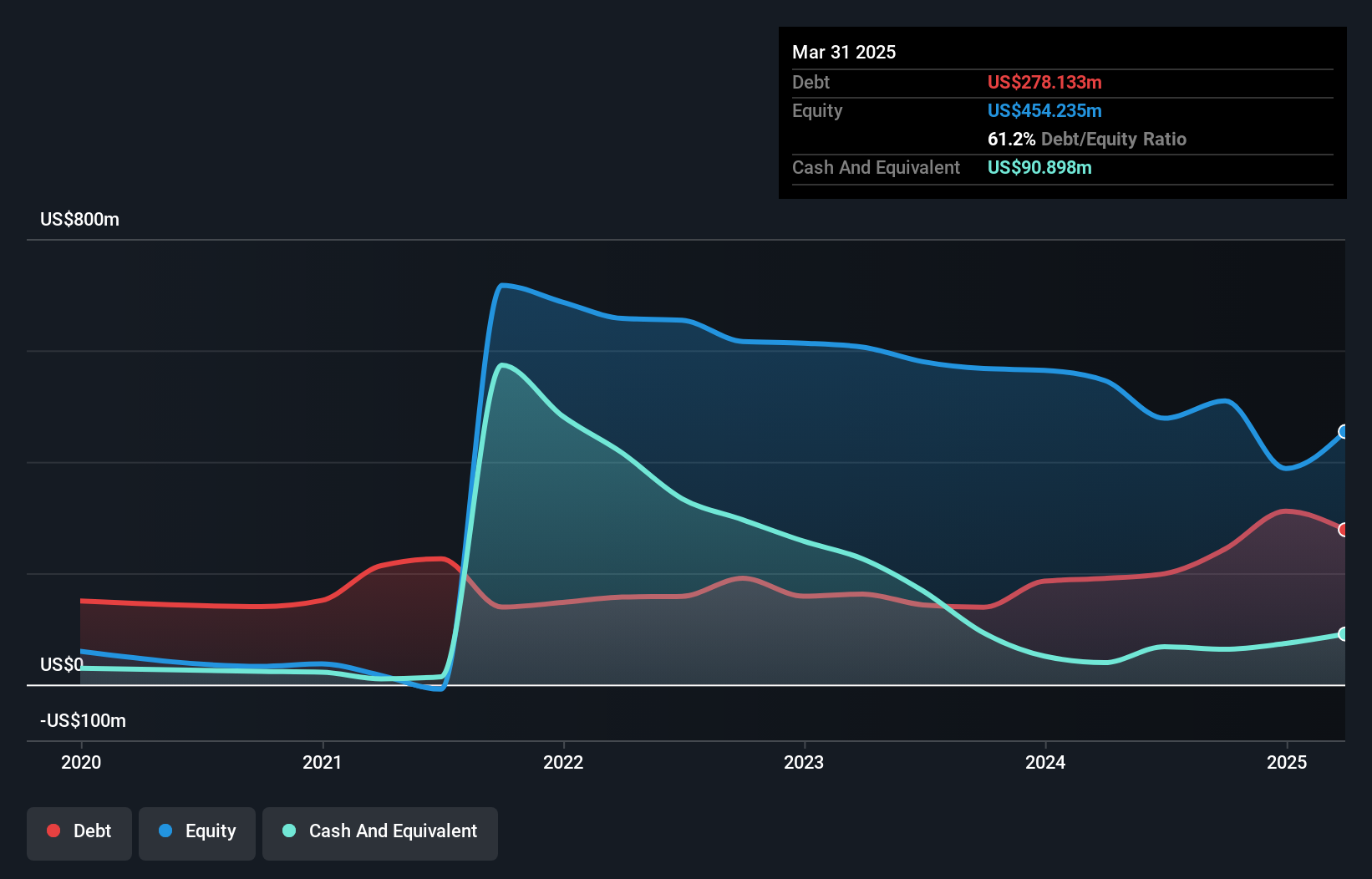

Microvast Holdings, Inc. has been making strides in the battery technology sector with a focus on high-performance products showcased at the China International Battery Fair 2025. The company reported a significant increase in first-quarter sales to US$116.49 million, achieving net income compared to a loss last year. Despite this progress, Microvast remains unprofitable and faces concerns over its ability to continue as a going concern due to historical losses and high debt levels. However, recent expansions and product innovations indicate potential for growth if financial stability can be maintained amidst volatile share prices and industry challenges.

- Jump into the full analysis health report here for a deeper understanding of Microvast Holdings.

- Evaluate Microvast Holdings' prospects by accessing our earnings growth report.

AC Immune (ACIU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AC Immune SA is a clinical stage biopharmaceutical company focused on discovering, designing, and developing medicines and diagnostic products for neurodegenerative diseases related to protein misfolding, with a market cap of $201.84 million.

Operations: No revenue segments are reported for this clinical stage biopharmaceutical company.

Market Cap: $201.84M

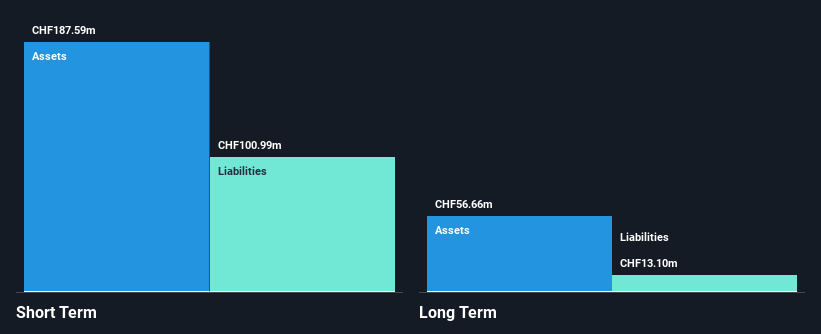

AC Immune SA, a clinical stage biopharmaceutical company, remains pre-revenue with CHF 0.99 million reported in Q1 2025. Despite being unprofitable and not expected to achieve profitability within the next three years, it benefits from a strong financial position with short-term assets significantly exceeding liabilities and no debt burden. The company has an experienced board and management team, contributing to strategic stability. While the stock trades significantly below estimated fair value, its cash runway extends beyond three years even as free cash flow shrinks slightly. Revenue is forecasted to grow substantially at over 43% annually despite current challenges in achieving profitability.

- Dive into the specifics of AC Immune here with our thorough balance sheet health report.

- Learn about AC Immune's future growth trajectory here.

Lexeo Therapeutics (LXEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lexeo Therapeutics, Inc. is a clinical-stage genetic medicine company concentrating on hereditary and acquired diseases with high unmet need in the United States, with a market cap of approximately $128.77 million.

Operations: Lexeo Therapeutics does not currently report any revenue segments.

Market Cap: $128.77M

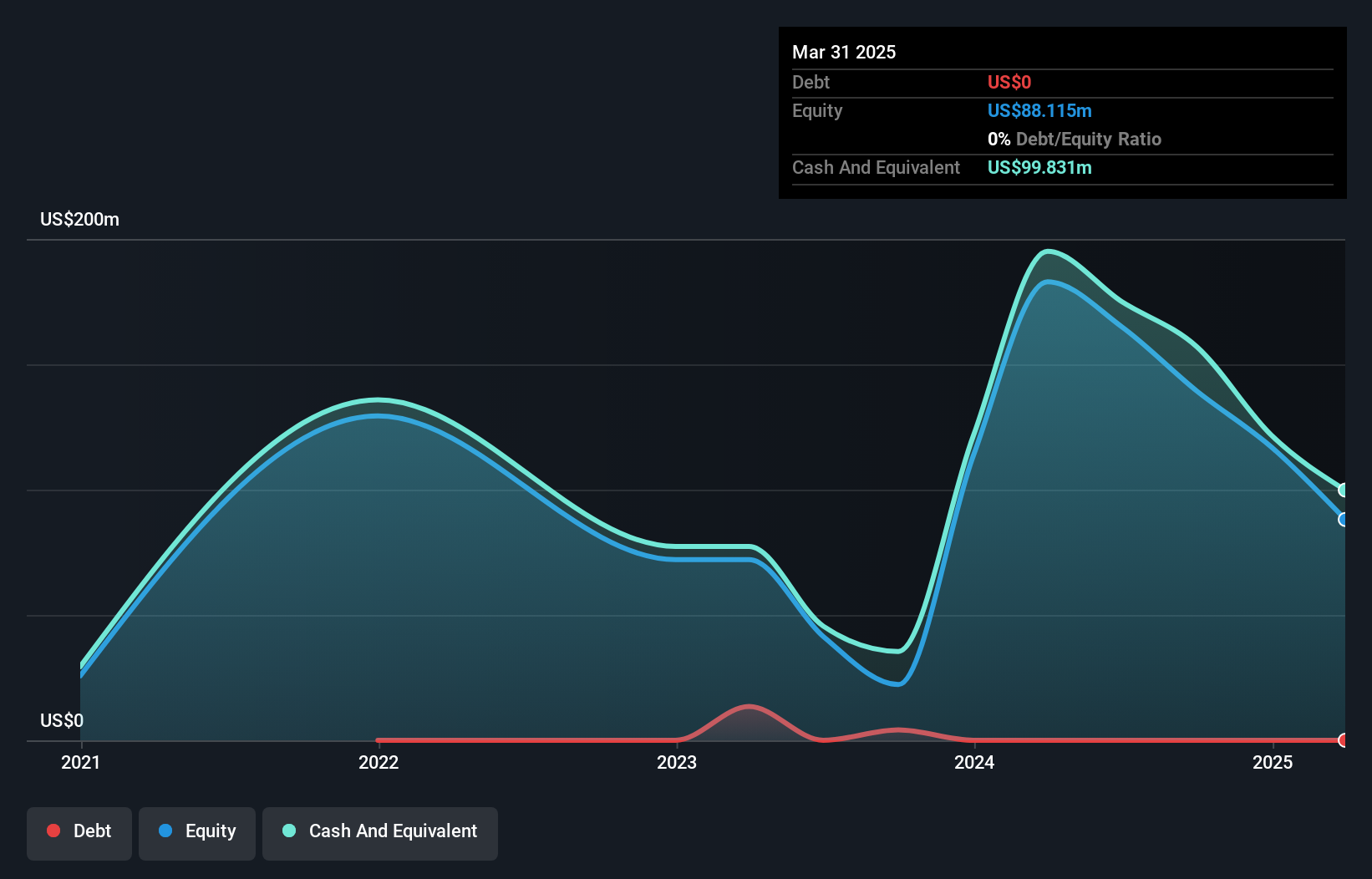

Lexeo Therapeutics, a pre-revenue clinical-stage genetic medicine company, has recently secured US$79.99 million through a private placement, strengthening its financial position with short-term assets of US$105.3 million exceeding liabilities. Despite being unprofitable and facing increased losses over the past five years, Lexeo maintains no debt and sufficient cash runway for at least 12 months. The company has shown promising interim data in its LX2006 trials for Friedreich ataxia cardiomyopathy and plans to advance to a registrational study by early 2026. However, the management team is relatively new with an average tenure of 1.3 years, potentially impacting strategic execution stability.

- Click to explore a detailed breakdown of our findings in Lexeo Therapeutics' financial health report.

- Assess Lexeo Therapeutics' future earnings estimates with our detailed growth reports.

Key Takeaways

- Gain an insight into the universe of 709 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives