- United States

- /

- Biotech

- /

- NasdaqCM:PROK

July 2025's Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, though it is up 13% over the past year with an optimistic forecast for earnings growth. In such a landscape, identifying stocks with strong financials becomes crucial, especially when considering investment opportunities like penny stocks. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still offer significant growth potential when backed by solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.43 | $513.56M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9214 | $148.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.37 | $243.42M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.73 | $443.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $97.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $2.06 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.85 | $6.15M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $5.00 | $46.41M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.51 | $431.16M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 424 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ProKidney (PROK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ProKidney Corp. is a clinical-stage biotechnology company focused on developing a cell therapy platform for treating multiple chronic kidney diseases in the United States, with a market cap of $177.53 million.

Operations: ProKidney Corp. has not reported any revenue segments as it is currently a clinical-stage biotechnology company.

Market Cap: $177.53M

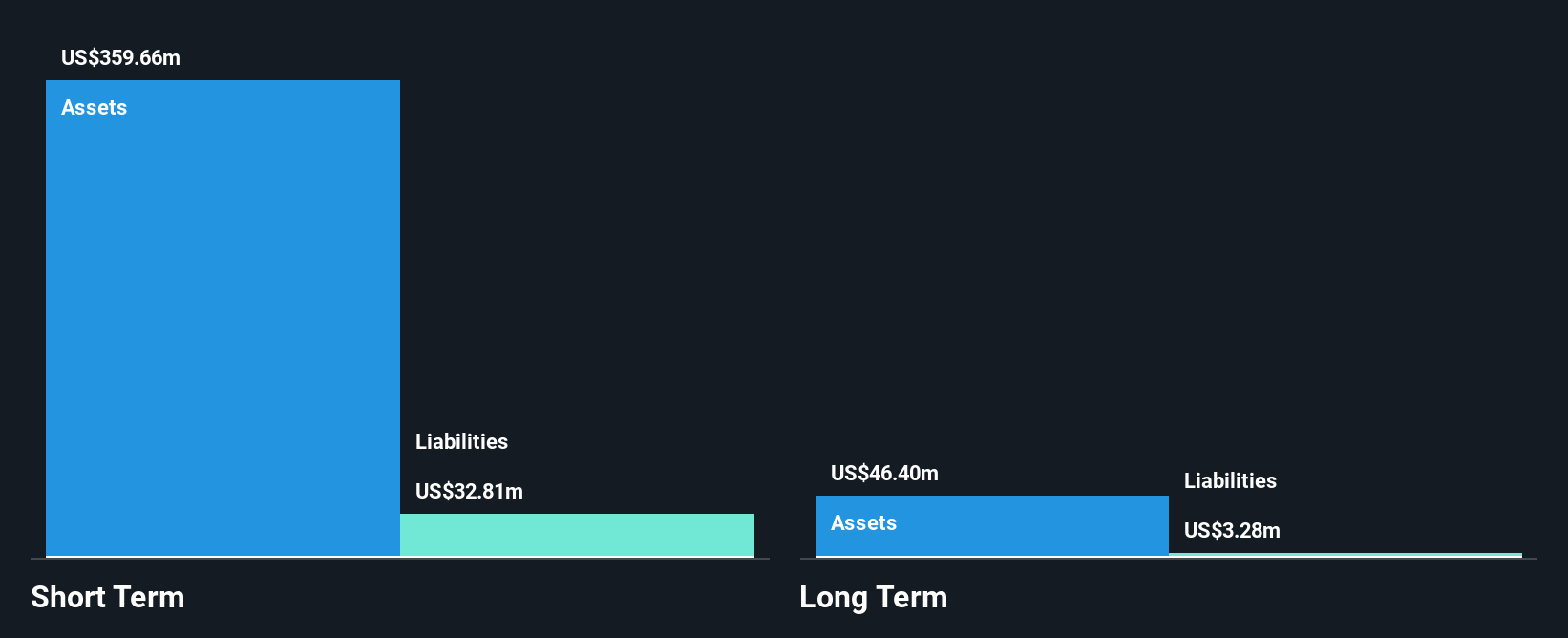

ProKidney Corp., with a market cap of US$177.53 million, is a pre-revenue clinical-stage biotechnology company focused on kidney disease therapies. Recent Phase 2 trial results for its cellular therapy rilparencel showed positive outcomes, supporting ongoing Phase 3 trials. Financially, the company remains unprofitable with minimal revenue (US$0.23 million in Q1 2025) and a significant net loss (US$16.73 million). Despite having no debt and sufficient short-term assets to cover liabilities, ProKidney faces challenges including increased volatility and an inexperienced management team. The company's cash runway extends over two years if current expenditure trends persist.

- Get an in-depth perspective on ProKidney's performance by reading our balance sheet health report here.

- Gain insights into ProKidney's future direction by reviewing our growth report.

Clean Energy Fuels (CLNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clean Energy Fuels Corp. provides natural gas as alternative fuels for vehicle fleets along with related fueling solutions in the United States and Canada, with a market cap of approximately $448.59 million.

Operations: The company's revenue primarily comes from supplying natural gas, generating $415.92 million.

Market Cap: $448.59M

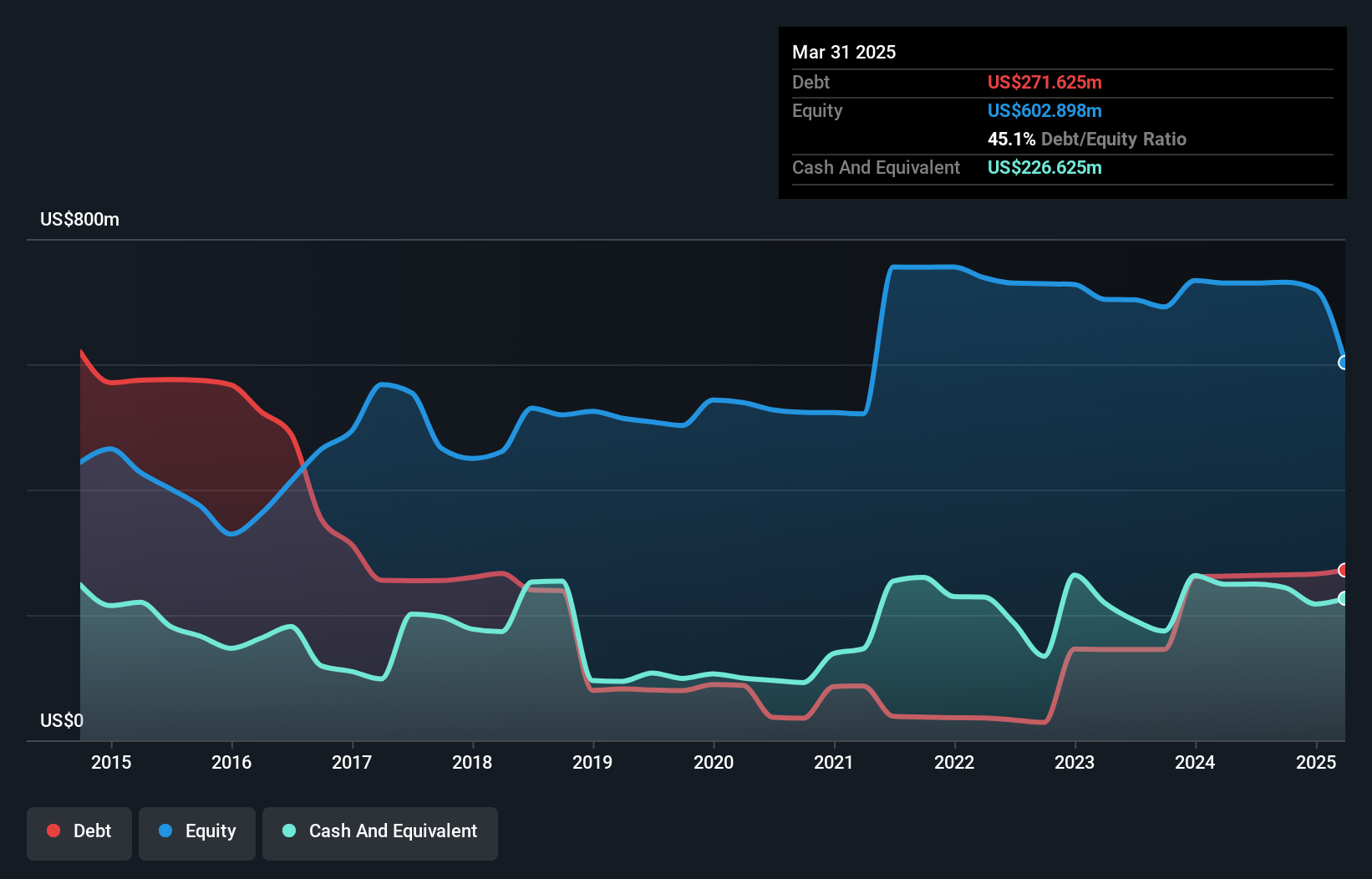

Clean Energy Fuels Corp., with a market cap of US$448.59 million, continues to face profitability challenges, reporting a significant net loss of US$134.97 million in Q1 2025 despite stable revenue at US$103.76 million. The company anticipates further losses for the year, partly due to non-cash charges and asset write-offs. While its share price remains highly volatile, Clean Energy maintains strong liquidity with short-term assets exceeding liabilities and no recent shareholder dilution. Despite an experienced management team and sufficient cash runway for over three years, the company's debt levels have increased over time, raising concerns about financial stability amidst ongoing expansion efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Clean Energy Fuels.

- Assess Clean Energy Fuels' future earnings estimates with our detailed growth reports.

ATRenew (RERE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $846.35 million.

Operations: The company generates revenue from its retail electronics segment, amounting to CN¥17.33 billion.

Market Cap: $846.35M

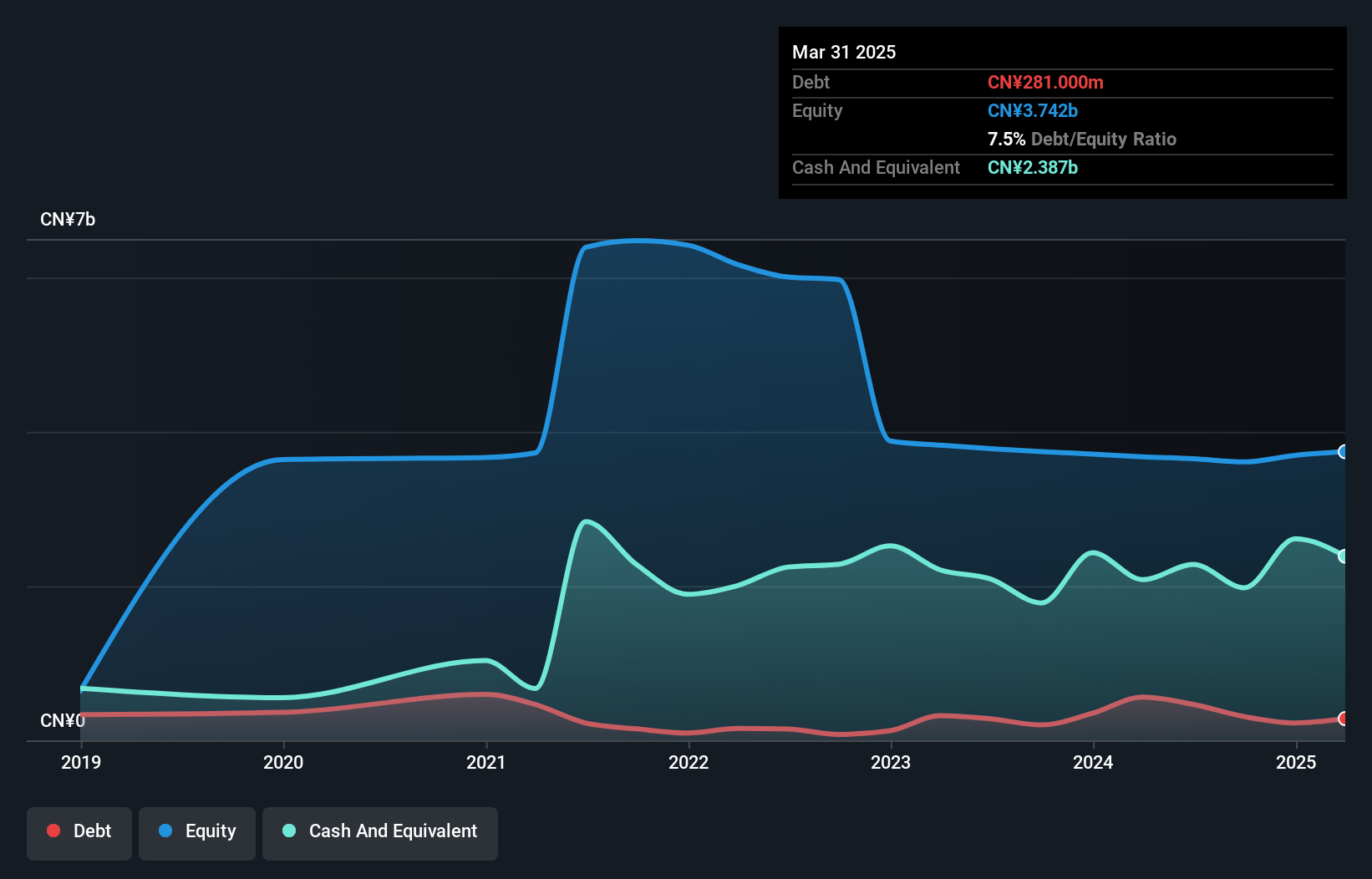

ATRenew Inc., with a market cap of approximately US$846.35 million, has shown financial improvement by becoming profitable recently, reporting a net income of CN¥42.8 million in Q1 2025 compared to a loss the previous year. The company has announced a share repurchase program worth up to US$50 million, indicating confidence in its cash position and future prospects. ATRenew's short-term assets substantially cover both short- and long-term liabilities, reflecting strong liquidity. However, despite reducing its debt-to-equity ratio over five years and having more cash than total debt, its return on equity remains low at 3.4%.

- Click here to discover the nuances of ATRenew with our detailed analytical financial health report.

- Understand ATRenew's earnings outlook by examining our growth report.

Next Steps

- Access the full spectrum of 424 US Penny Stocks by clicking on this link.

- Curious About Other Options? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PROK

ProKidney

A clinical-stage biotechnology company, develops a cell therapy platform for the treatment of multiple chronic kidney diseases in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives