- Hong Kong

- /

- Construction

- /

- SEHK:1459

Jujiang Construction Group (HKG:1459) Has A Rock Solid Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Jujiang Construction Group Co., Ltd. (HKG:1459) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Jujiang Construction Group

What Is Jujiang Construction Group's Net Debt?

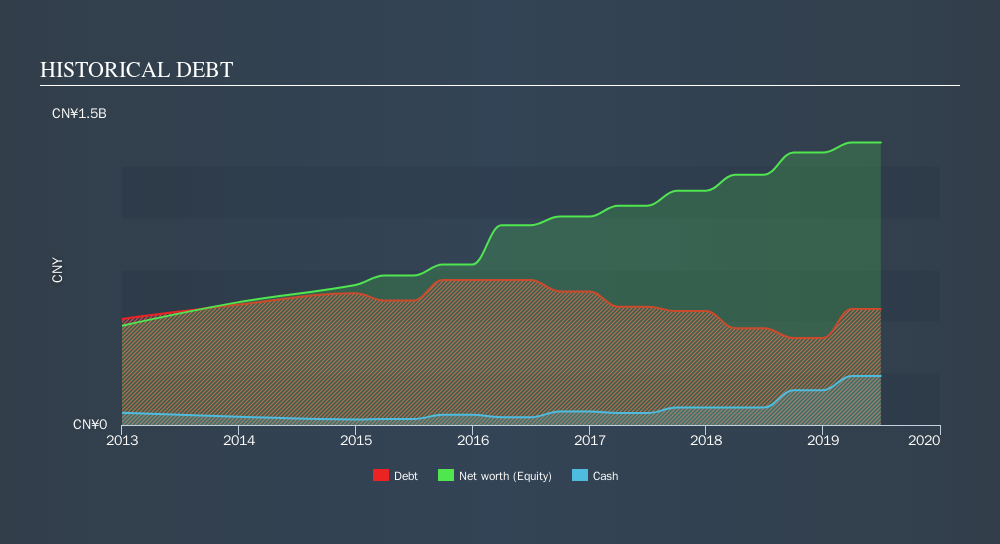

The image below, which you can click on for greater detail, shows that at June 2019 Jujiang Construction Group had debt of CN¥560.1m, up from CN¥466.7m in one year. However, it also had CN¥236.9m in cash, and so its net debt is CN¥323.2m.

A Look At Jujiang Construction Group's Liabilities

The latest balance sheet data shows that Jujiang Construction Group had liabilities of CN¥3.83b due within a year, and liabilities of CN¥102.4m falling due after that. Offsetting this, it had CN¥236.9m in cash and CN¥4.21b in receivables that were due within 12 months. So it actually has CN¥519.1m more liquid assets than total liabilities.

This luscious liquidity implies that Jujiang Construction Group's balance sheet is sturdy like a giant sequoia tree. On this view, it seems its balance sheet is as strong as a black-belt karate master.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Jujiang Construction Group has net debt of just 1.1 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 7.2 times, which is more than adequate. Fortunately, Jujiang Construction Group grew its EBIT by 7.7% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is Jujiang Construction Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Jujiang Construction Group actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Jujiang Construction Group's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And that's just the beginning of the good news since its level of total liabilities is also very heartening. It looks Jujiang Construction Group has no trouble standing on its own two feet, and it has no reason to fear its lenders. To our minds it has a healthy happy balance sheet. Given Jujiang Construction Group has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1459

Jujiang Construction Group

Provides construction contracting services for residential, commercial, industrial, and public works in the People’s Republic of China and Hong Kong.

Adequate balance sheet low.

Market Insights

Community Narratives