- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Enhances Self-Directed Investing With New Fixed Income Features

Reviewed by Simply Wall St

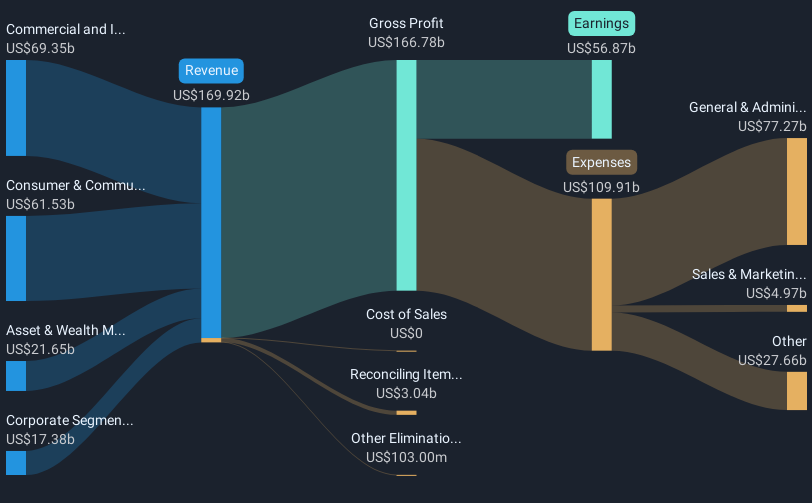

JPMorgan Chase (NYSE:JPM) recently unveiled significant enhancements to its Self-Directed Investing platform, aimed at improving user experience for fixed income investors. This initiative aligns with the company's existing strategies to support customer wealth growth and comes amid a broader 13% rise in the company’s stock over the last quarter. This period also saw a reinforcing of its dividend strategy, with a quarterly dividend declaration, and an earnings report reflecting solid financial performance. While the market faced turmoil due to geopolitical tensions and oil price fluctuations, JPMorgan's innovations and consistent earnings likely supported its positive trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent enhancement to JPMorgan Chase's Self-Directed Investing platform aims to bolster user experience in fixed income investments. This move aligns with the company's ongoing investment and technology strategy, potentially strengthening its service offerings. Despite higher credit loss allowances and rising expenses, focusing on customer wealth growth could mitigate pressure on net margins. Over the past five years, JPMorgan's total return, including share price and dividends, reached a significant 240.03%, suggesting long-term growth despite short-term fluctuations.

When comparing one-year returns, JPMorgan surpassed the US Banks industry's return of 24.4% and the broader US market's 10.4% return. The recent initiatives might influence revenue and earnings projections by potentially attracting increased investor activity and revenues, amidst cautious credit loss expectations. Analysts forecast a decline in earnings over the next three years, with potential rate cuts and a cautious investment banking outlook impacting profitability. Notably, the share price's proximity to consensus price targets reflects the ongoing debate among analysts about the equity's fair valuation. Current trading price is close to the average analyst price target of US$270.41, implying limited upside in the near term.

Learn about JPMorgan Chase's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives