- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM) Updates Bylaws And Appoints New Infrastructure Investment Co-Head

Reviewed by Simply Wall St

JPMorgan Chase (JPM) recently saw significant developments, including a by-laws amendment and the appointment of a new global co-head for infrastructure investment banking. These changes align with its strategic growth initiatives. Over the last quarter, JPMorgan's stock price rose 16%, a performance that aligns with broader market gains, as the Nasdaq and S&P 500 also posted record highs and weekly gains. The broader market saw strength driven by expectations of Federal Reserve interest rate cuts. These corporate leadership enhancements and strategic decisions at JPMorgan would likely have supported the market's positive trajectory during this period.

JPMorgan Chase has 1 warning sign we think you should know about.

The recent developments at JPMorgan Chase, including changes to its by-laws and strategic appointments, could bolster its operational focus, particularly in infrastructure investment banking. This emphasis aligns with its broader growth initiatives, potentially enhancing revenue streams and supporting earnings resilience despite anticipated credit losses and expense pressures. Such proactive steps might mitigate near-term profitability challenges highlighted in the firm’s outlook, suggesting a strategic balancing of its investment banking and asset management strengths.

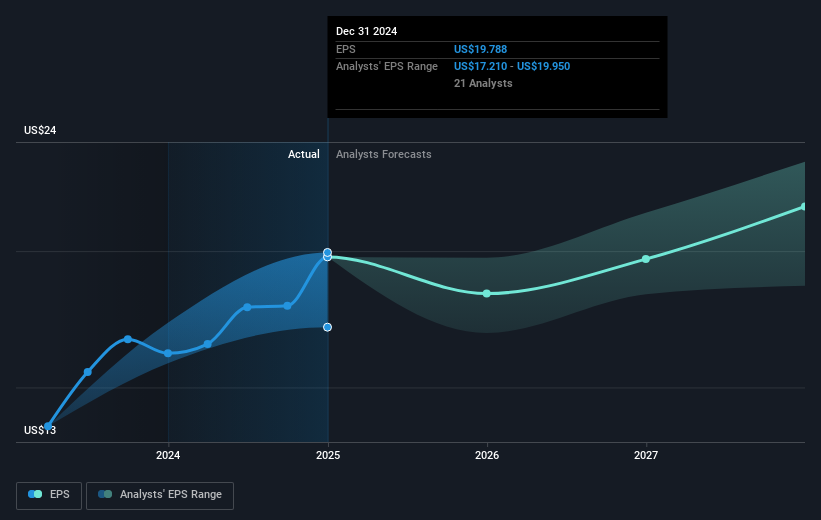

Over the past five years, JPMorgan's total shareholder return, which includes share price appreciation and dividends, stood at approximately 257%. This robust performance outpaces the broader US market, which returned 18.5% over the past year. Although JPMorgan's earnings growth of 5.6% in the past year lagged behind the banks industry average of 13%, it exceeded both the US market's annual performance and the US Banks industry over the same period.

The recent 16% rise in the company's stock over the last quarter, amidst broader market strength, places its current share price in proximity to the consensus price target of US$306.17. This may reflect aligned market expectations with analyst values, balancing potential revenue impairments from reduced net interest income and cautious investment banking projections. With a share price marginally above this target, analyst consensus suggests limited headroom for immediate further valuation gains without exceeding current market expectations.

Click to explore a detailed breakdown of our findings in JPMorgan Chase's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives