- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM) Eyes Apple Card Portfolio and Partners with Coinbase

Reviewed by Simply Wall St

JPMorgan Chase (JPM) has recently been in discussions to acquire Apple's credit card portfolio, which could significantly impact its financial services division. The company's stock saw a 21% increase over the last quarter, during which time it also initiated a strategic alliance with Coinbase, enhancing its offerings in the cryptocurrency space. These developments coincided with broader market trends, characterized by strong earnings from companies like Microsoft and Meta, which contributed to positive investor sentiment. Despite mixed earnings results, including a decline in net income, these strategic moves might have added weight to JPMorgan's substantial stock price gain.

We've spotted 1 possible red flag for JPMorgan Chase you should be aware of.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

The potential acquisition of Apple's credit card portfolio by JPMorgan Chase and its alliance with Coinbase could influence not only the company’s share price but also its longer-term revenue and earnings forecasts. By diversifying into Apple's financial products and expanding cryptocurrency services, these moves may foster enhanced revenue streams within its financial services division. However, increased credit loss allowances and expenses from recent operations could temper future profitability predictions.

JPMorgan's shares have exhibited a substantial total return of 252.49% over the past five years. This historical performance underscores significant investor confidence and reflects long-term growth, contrasting with the broader US Banks industry, which saw an 11.1% increase in earnings over the past year. In comparison, JPMorgan outperformed the market over the past year, with its 1-year return exceeding the US market return of 15.7% and the industry return of 22.1%.

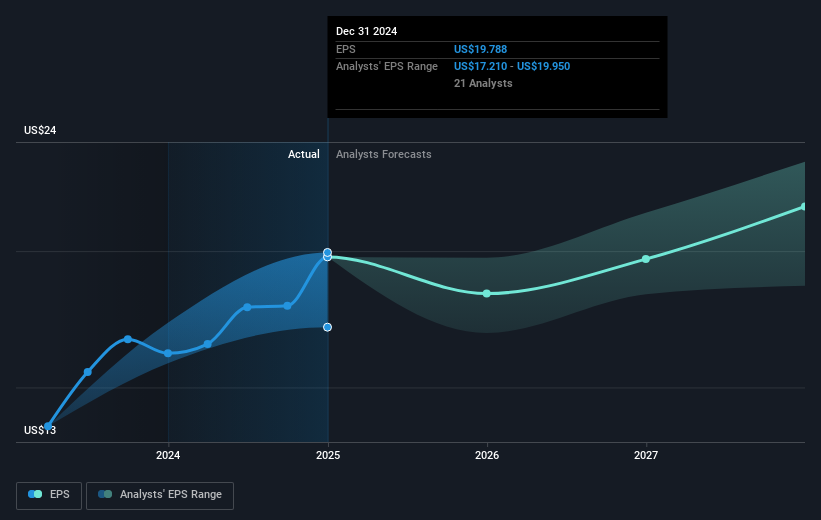

With a current share price of US$299.63, just shy of its consensus analyst price target of US$303.57, the price movement suggests market expectations align closely with analyst valuations. This proximity to the price target highlights the market's cautious optimism regarding the bank’s potential profitability amidst external economic changes. Optimistic forecasts of cutting-edge tech investments and strategic partnerships might bolster the company's prospects, but elevated credit reserves and pending economic fluctuations could constrain revenue and earnings projections in the near future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives