- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (NYSE:JNJ) Submits sNDA For Schizophrenia Drug CAPLYTA® To FDA

Reviewed by Simply Wall St

Johnson & Johnson (NYSE:JNJ) submitted a supplemental New Drug Application for CAPLYTA®, aiming to prevent schizophrenia relapse, marking a significant step in expanding its mental health portfolio. Over the last quarter, Johnson & Johnson's stock price increased by 4%. This movement aligns with the broader market trends, which have shown steady growth despite some trade uncertainties. The company's efforts in the pharmaceutical sector and robust earnings likely contributed positively to its share performance. The dividend increase and favorable earnings report further supported the company's stock stability amid mixed economic signals.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

Johnson & Johnson's recent submission of a supplemental New Drug Application for CAPLYTA® could further strengthen its footing in the mental health space. With an estimated potential for CAPLYTA to achieve over US$5 billion in peak sales, this development aligns well with the company's strategy to bolster revenue through innovative medicines, even as it faces challenges such as the loss of exclusivity for STELARA. The anticipated approval and subsequent market introduction of CAPLYTA may positively influence future revenue and earnings projections.

Over the past five years, Johnson & Johnson's total shareholder return, including share price appreciation and dividends, was 23.24%. Although this reflects a positive trend over a significant period, in the past year, its performance lagged behind the broader US Market, which saw a return of 12.5%. Despite underperforming in the short term, the company's shares have demonstrated robust longer-term growth.

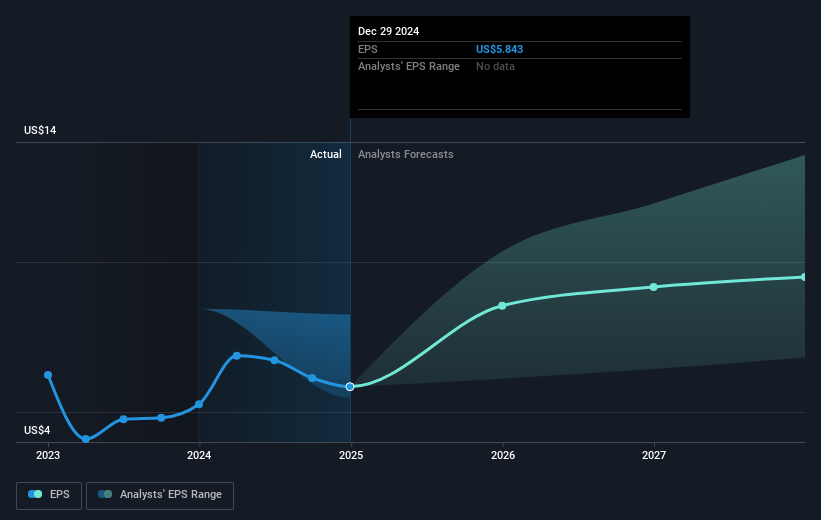

Looking ahead, new innovations such as CAPLYTA are expected to have a tangible impact on Johnson & Johnson's revenue and earnings forecasts. Analysts project revenue growth at 3.7% annually over the next three years, with earnings potentially reaching US$22.9 billion by mid-2028. The current share price of US$154.47 is trading at a discount to the analyst consensus price target of US$169.98, indicating potential upside. However, investors should compare these forecasts against their own assumptions and the inherent risks faced by Johnson & Johnson, including litigation and tariffs, which could influence these projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives