- Sweden

- /

- Communications

- /

- OM:ERIC B

It Might Not Be A Great Idea To Buy Telefonaktiebolaget LM Ericsson (publ) (STO:ERIC B) For Its Next Dividend

Readers hoping to buy Telefonaktiebolaget LM Ericsson (publ) (STO:ERIC B) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 1st of April in order to receive the dividend, which the company will pay on the 7th of April.

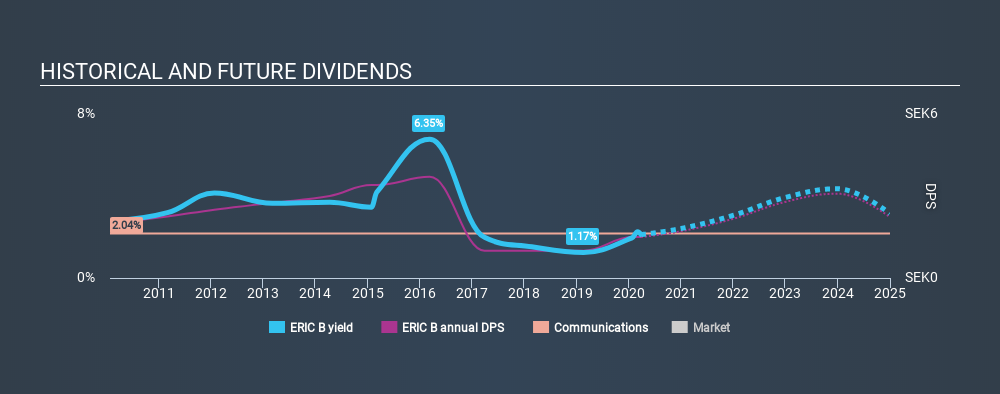

Telefonaktiebolaget LM Ericsson's next dividend payment will be kr0.75 per share, on the back of last year when the company paid a total of kr1.50 to shareholders. Based on the last year's worth of payments, Telefonaktiebolaget LM Ericsson has a trailing yield of 2.0% on the current stock price of SEK75.6. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Telefonaktiebolaget LM Ericsson can afford its dividend, and if the dividend could grow.

See our latest analysis for Telefonaktiebolaget LM Ericsson

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Telefonaktiebolaget LM Ericsson paid out a disturbingly high 223% of its profit as dividends last year, which makes us concerned there's something we don't fully understand in the business. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It distributed 32% of its free cash flow as dividends, a comfortable payout level for most companies.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Telefonaktiebolaget LM Ericsson fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Telefonaktiebolaget LM Ericsson's 28% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Telefonaktiebolaget LM Ericsson has seen its dividend decline 2.8% per annum on average over the past ten years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Has Telefonaktiebolaget LM Ericsson got what it takes to maintain its dividend payments? It's never great to see earnings per share declining, especially when a company is paying out 223% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of Telefonaktiebolaget LM Ericsson don't faze you, it's worth being mindful of the risks involved with this business. To help with this, we've discovered 2 warning signs for Telefonaktiebolaget LM Ericsson that you should be aware of before investing in their shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives