- Israel

- /

- Aerospace & Defense

- /

- TASE:ARDM

Islamic Arab Insurance (Salama) PJSC And 2 Other Promising Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown positive momentum, driven by steady non-oil private sector growth and investor optimism around global trade deals. Penny stocks, though often seen as a relic of the past, continue to offer intriguing opportunities for investors seeking growth in smaller or newer companies. When these stocks are supported by strong financial health and solid fundamentals, they can present valuable prospects for those willing to explore this niche segment of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.52 | ₪11.58M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.16 | SAR1.66B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.09 | AED2.71B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.669 | ₪328.38M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.10 | AED2.2B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.96 | TRY2.11B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.06 | AED353.43M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.56 | AED10.89B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.832 | AED506.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.571 | ₪191.13M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance (Salama) PJSC, operating with its subsidiaries, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED373.72 million.

Operations: The company generates revenue from Family Takaful at AED228.53 million and General Takaful at AED802.73 million.

Market Cap: AED373.72M

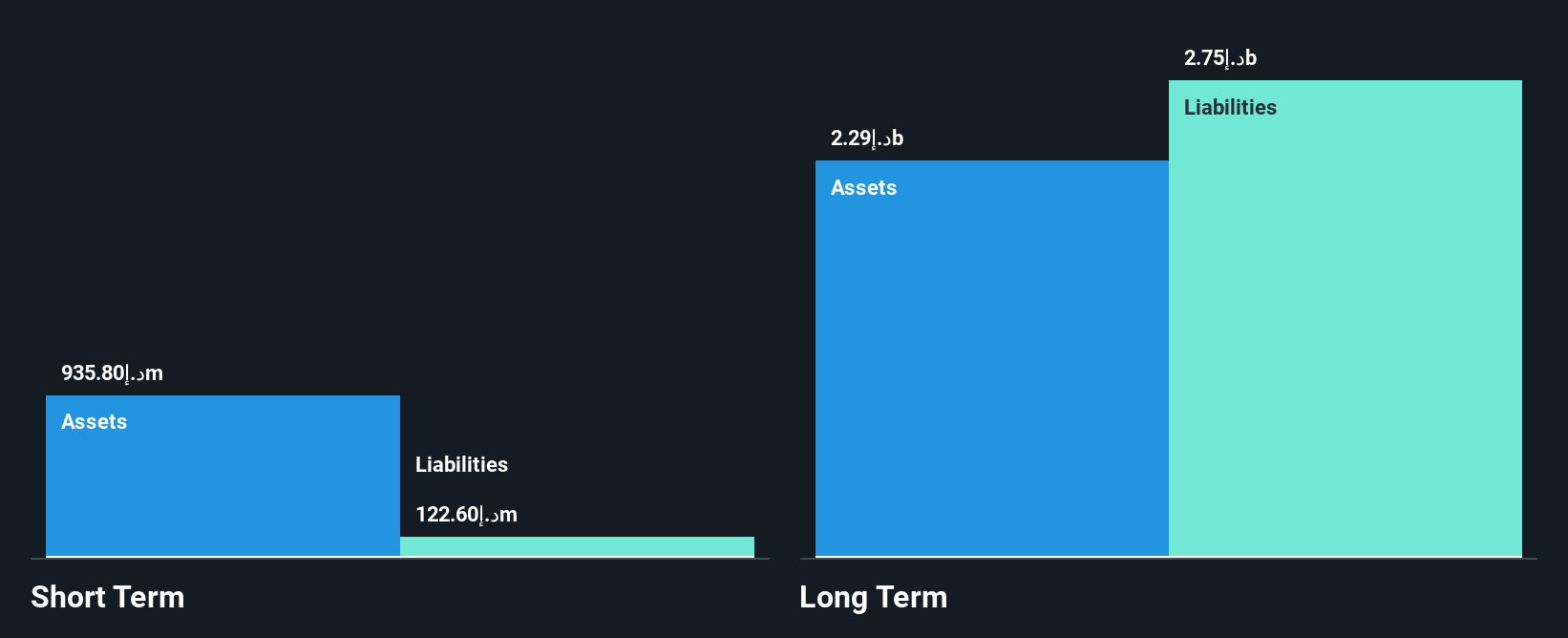

Islamic Arab Insurance (Salama) PJSC, with a market cap of AED373.72 million, has shown mixed performance as a penny stock. The company reported a net loss of AED0.974 million for Q1 2025, contrasting with a net income of AED10.12 million the previous year, highlighting recent financial challenges. Despite becoming profitable over the past five years and having no debt obligations, Salama's return on equity remains low at 2.2%. While short-term assets exceed short-term liabilities by AED315.4 million, long-term liabilities are not fully covered by these assets, indicating potential financial risks ahead despite its stable volatility profile.

- Click to explore a detailed breakdown of our findings in Islamic Arab Insurance (Salama) PJSC's financial health report.

- Explore historical data to track Islamic Arab Insurance (Salama) PJSC's performance over time in our past results report.

Aerodrome Group (TASE:ARDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aerodrome Group Ltd specializes in offering UAV-based solutions for data collection, processing, and analysis using advanced software and AI in civil and security markets, with a market cap of ₪37.52 million.

Operations: The company generates revenue through two main segments: Air Intelligence, contributing ₪11.61 million, and Know-How Sharing, which accounts for ₪2.84 million.

Market Cap: ₪37.52M

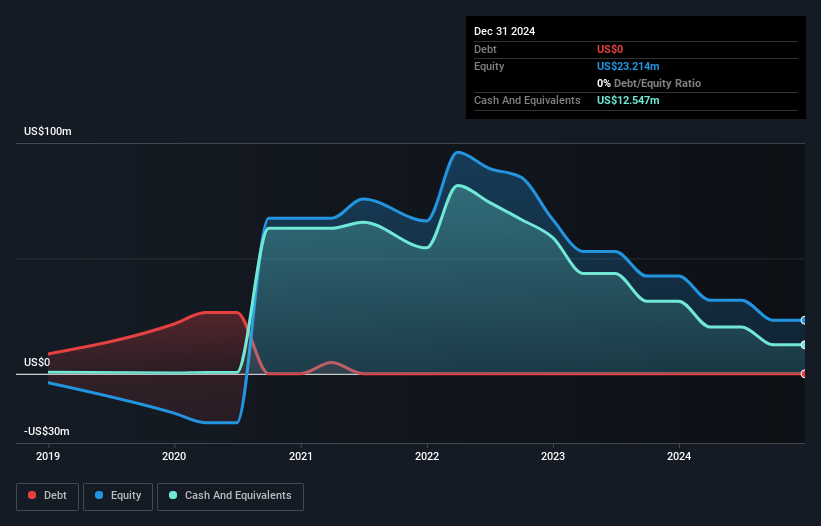

Aerodrome Group Ltd, with a market cap of ₪37.52 million, operates in the UAV-based solutions sector, generating revenue primarily through Air Intelligence (₪11.61 million) and Know-How Sharing (₪2.84 million). Despite having more cash than total debt and short-term assets exceeding liabilities, the company is currently unprofitable with a negative return on equity of -79.3%. It faces challenges like high volatility and less than a year of cash runway if current cash flow trends continue. The management team has an average tenure of 2.4 years, reflecting some experience amidst financial uncertainties.

- Unlock comprehensive insights into our analysis of Aerodrome Group stock in this financial health report.

- Review our historical performance report to gain insights into Aerodrome Group's track record.

Gencell (TASE:GNCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GenCell Ltd. develops and produces fuel cell-based energy systems, with a market cap of ₪27.16 million.

Operations: The company's revenue of $9.55 million is derived from its development and production activities focused on fuel cell-based energy systems.

Market Cap: ₪27.16M

GenCell Ltd., with a market cap of ₪27.16 million, is focused on fuel cell-based energy systems and reports revenue of $9.55 million. Despite being debt-free and having short-term assets surpassing both long-term ($1.4M) and short-term liabilities ($7.1M), the company faces financial hurdles due to its unprofitability, declining earnings over five years, and less than a year of cash runway if current trends persist. The experienced management team (2.5 years average tenure) navigates high share price volatility, while shareholders have not faced significant dilution recently amidst these challenges.

- Click here to discover the nuances of Gencell with our detailed analytical financial health report.

- Learn about Gencell's historical performance here.

Next Steps

- Discover the full array of 79 Middle Eastern Penny Stocks right here.

- Curious About Other Options? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARDM

Aerodrome Group

Provides solutions for collecting, processing, and analyzing information from the air using unmanned aerial vehicles (UAVs), advanced software, and artificial intelligence applications in the civil and security markets.

Moderate with adequate balance sheet.

Market Insights

Community Narratives