The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, West Fraser Timber Co. Ltd. (TSE:WFT) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for West Fraser Timber

How Much Debt Does West Fraser Timber Carry?

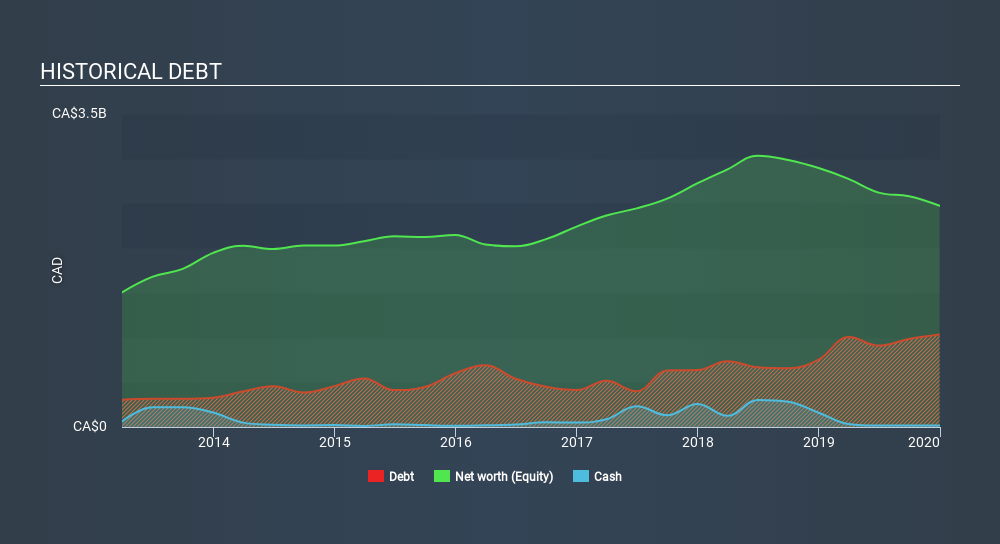

As you can see below, at the end of December 2019, West Fraser Timber had CA$1.03b of debt, up from CA$753.0m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is West Fraser Timber's Balance Sheet?

According to the last reported balance sheet, West Fraser Timber had liabilities of CA$837.0m due within 12 months, and liabilities of CA$1.36b due beyond 12 months. On the other hand, it had cash of CA$16.0m and CA$393.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$1.79b.

This is a mountain of leverage relative to its market capitalization of CA$1.99b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if West Fraser Timber can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, West Fraser Timber made a loss at the EBIT level, and saw its revenue drop to CA$4.9b, which is a fall of 20%. To be frank that doesn't bode well.

Caveat Emptor

While West Fraser Timber's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at CA$134m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through CA$295m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for West Fraser Timber (of which 1 can't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives