Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Theratechnologies Inc. (TSE:TH) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Theratechnologies

What Is Theratechnologies's Net Debt?

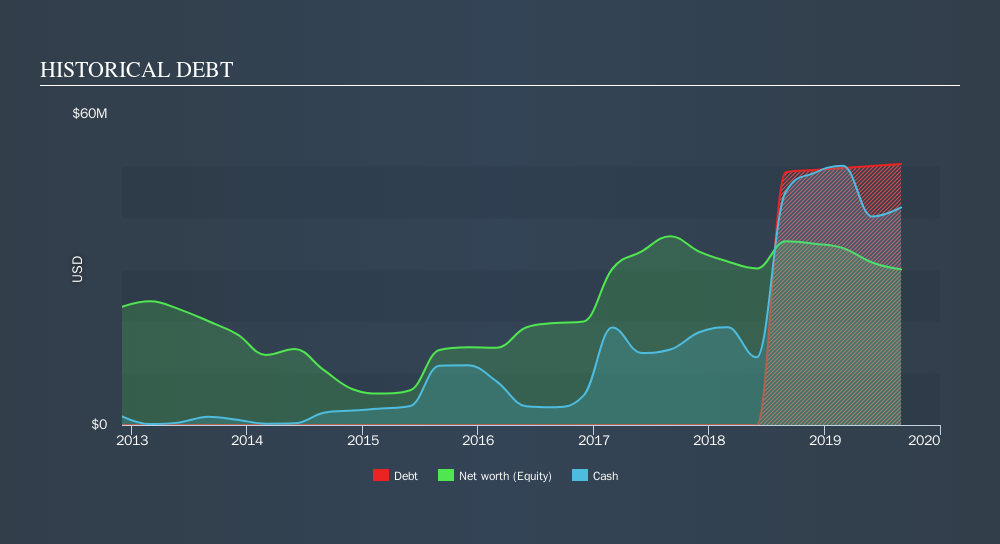

The chart below, which you can click on for greater detail, shows that Theratechnologies had US$50.3m in debt in August 2019; about the same as the year before. However, because it has a cash reserve of US$42.0m, its net debt is less, at about US$8.38m.

How Strong Is Theratechnologies's Balance Sheet?

The latest balance sheet data shows that Theratechnologies had liabilities of US$27.4m due within a year, and liabilities of US$50.6m falling due after that. On the other hand, it had cash of US$42.0m and US$11.4m worth of receivables due within a year. So it has liabilities totalling US$24.7m more than its cash and near-term receivables, combined.

Given Theratechnologies has a market capitalization of US$305.7m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Theratechnologies can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Theratechnologies reported revenue of US$60m, which is a gain of 46%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Theratechnologies still had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at US$2.9m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$24m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Theratechnologies's profit, revenue, and operating cashflow have changed over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:TH

Theratechnologies

A biopharmaceutical company, focuses on the commercialization of various therapies to address the unmet medical needs in the United States, Canada, and Europe.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives