- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Is Texas Instruments Incorporated's (NASDAQ:TXN) Stock's Recent Performance A Reflection Of Its Financial Health?

Most readers would already know that Texas Instruments' (NASDAQ:TXN) stock increased by 6.9% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Texas Instruments' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Texas Instruments

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Texas Instruments is:

66% = US$5.0b ÷ US$7.6b (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.66 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Texas Instruments' Earnings Growth And 66% ROE

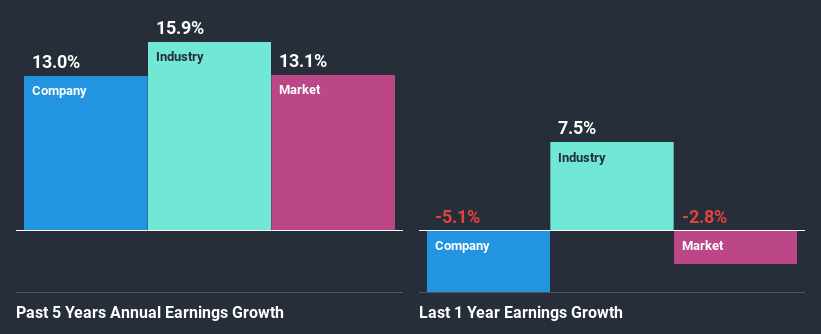

First thing first, we like that Texas Instruments has an impressive ROE. Second, a comparison with the average ROE reported by the industry of 11% also doesn't go unnoticed by us. Probably as a result of this, Texas Instruments was able to see a decent net income growth of 13% over the last five years.

Next, on comparing Texas Instruments' net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 16% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Texas Instruments fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Texas Instruments Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 53% (or a retention ratio of 47%) for Texas Instruments suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Besides, Texas Instruments has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 70% over the next three years. Regardless, the future ROE for Texas Instruments is speculated to rise to 92% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Conclusion

Overall, we are quite pleased with Texas Instruments' performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Texas Instruments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives