- Italy

- /

- Aerospace & Defense

- /

- BIT:TPS

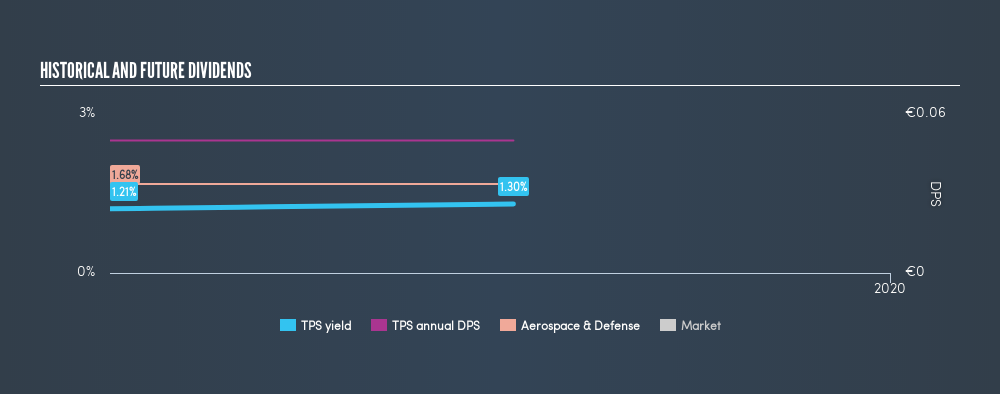

Is Technical Publications Service S.p.A.'s (BIT:TPS) 1.3% Dividend Worth Your Time?

Dividend paying stocks like Technical Publications Service S.p.A. (BIT:TPS) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

Some simple research can reduce the risk of buying Technical Publications Service for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 17% of Technical Publications Service's profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was €0.05 per share.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. EPS have fallen -17% over the last 12 months. While this is not ideal, one year is a short time in business, and we wouldn't want to get too hung up on this. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

We'd also point out that Technical Publications Service issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Technical Publications Service has low and conservative payout ratios. Unfortunately, there hasn't been any earnings growth, and the company's dividend history has been too short for us to evaluate the consistency of the dividend. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Technical Publications Service out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Technical Publications Service stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:TPS

Technical Publications Service

Engages in the provision of engineering and digital services in Italy.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives