- United States

- /

- Specialty Stores

- /

- NasdaqGS:SFIX

Is Stitch Fix, Inc.'s (NASDAQ:SFIX) 6.4% ROE Worse Than Average?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Stitch Fix, Inc. (NASDAQ:SFIX).

Stitch Fix has a ROE of 6.4%, based on the last twelve months. One way to conceptualize this, is that for each $1 of shareholders' equity it has, the company made $0.06 in profit.

See our latest analysis for Stitch Fix

How Do I Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Or for Stitch Fix:

6.4% = US$26m ÷ US$409m (Based on the trailing twelve months to November 2019.)

Most readers would understand what net profit is, but it’s worth explaining the concept of shareholders’ equity. It is the capital paid in by shareholders, plus any retained earnings. The easiest way to calculate shareholders' equity is to subtract the company's total liabilities from the total assets.

What Does ROE Mean?

Return on Equity measures a company's profitability against the profit it has kept for the business (plus any capital injections). The 'return' is the amount earned after tax over the last twelve months. The higher the ROE, the more profit the company is making. So, all else being equal, a high ROE is better than a low one. That means ROE can be used to compare two businesses.

Does Stitch Fix Have A Good ROE?

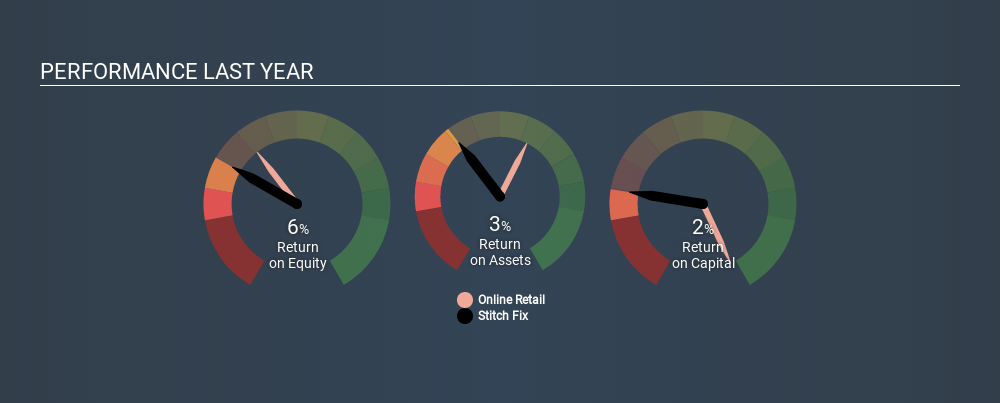

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. If you look at the image below, you can see Stitch Fix has a lower ROE than the average (10.0%) in the Online Retail industry classification.

That's not what we like to see. We'd prefer see an ROE above the industry average, but it might not matter if the company is undervalued. Nonetheless, it could be useful to double-check if insiders have sold shares recently.

Why You Should Consider Debt When Looking At ROE

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Stitch Fix's Debt And Its 6.4% ROE

Shareholders will be pleased to learn that Stitch Fix has not one iota of net debt! So although its ROE isn't that impressive, we shouldn't judge it harshly on that metric, because it didn't use debt. At the end of the day, when a company has zero debt, it is in a better position to take future growth opportunities.

The Bottom Line On ROE

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In my book the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So I think it may be worth checking this free report on analyst forecasts for the company.

Of course Stitch Fix may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:SFIX

Stitch Fix

Sells a range of apparel, shoes, and accessories for women’s, petite, maternity, men’s, plus, and kids through its website and mobile application in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives