- Hong Kong

- /

- Electrical

- /

- SEHK:8115

Is Shanghai Qingpu Fire-Fighting Equipment (HKG:8115) Using Debt In A Risky Way?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Shanghai Qingpu Fire-Fighting Equipment Co., Ltd. (HKG:8115) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Shanghai Qingpu Fire-Fighting Equipment

What Is Shanghai Qingpu Fire-Fighting Equipment's Net Debt?

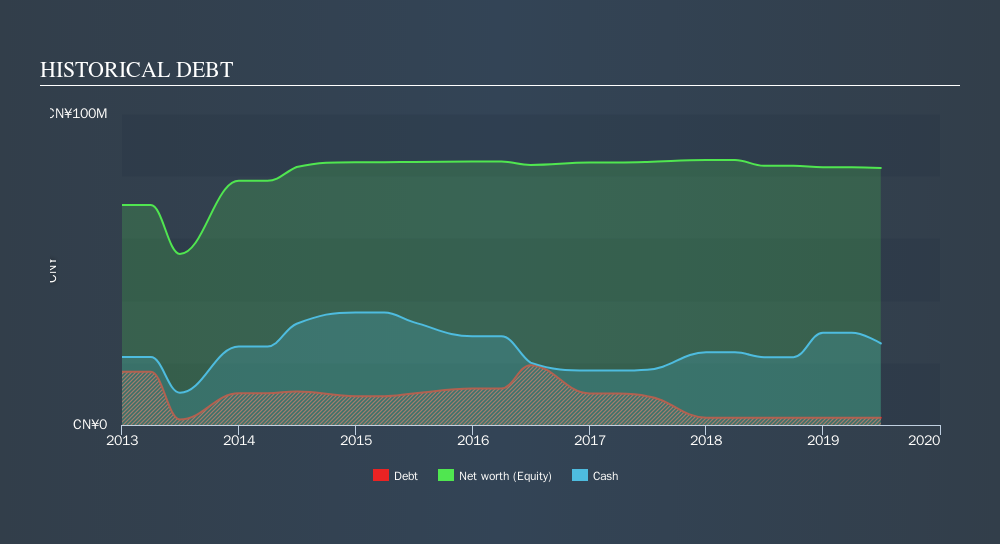

As you can see below, Shanghai Qingpu Fire-Fighting Equipment had CN¥2.36m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. But on the other hand it also has CN¥26.2m in cash, leading to a CN¥23.9m net cash position.

A Look At Shanghai Qingpu Fire-Fighting Equipment's Liabilities

According to the last reported balance sheet, Shanghai Qingpu Fire-Fighting Equipment had liabilities of CN¥19.5m due within 12 months, and liabilities of CN¥5.45m due beyond 12 months. Offsetting this, it had CN¥26.2m in cash and CN¥17.6m in receivables that were due within 12 months. So it can boast CN¥18.9m more liquid assets than total liabilities.

This excess liquidity suggests that Shanghai Qingpu Fire-Fighting Equipment is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Shanghai Qingpu Fire-Fighting Equipment boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Shanghai Qingpu Fire-Fighting Equipment will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Shanghai Qingpu Fire-Fighting Equipment wasn't profitable at an EBIT level, but managed to grow its revenue by13%, to CN¥76m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Shanghai Qingpu Fire-Fighting Equipment?

While Shanghai Qingpu Fire-Fighting Equipment lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow CN¥6.2m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. For riskier companies like Shanghai Qingpu Fire-Fighting Equipment I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8115

Shanghai Qingpu Fire-Fighting Equipment

Manufactures and sells firefighting equipment and pressure vessel products in the People’s Republic of China, the European Union, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives