- Brazil

- /

- Real Estate

- /

- BOVESPA:SCAR3

Is São Carlos Empreendimentos e Participações (BVMF:SCAR3) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that São Carlos Empreendimentos e Participações S.A. (BVMF:SCAR3) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for São Carlos Empreendimentos e Participações

How Much Debt Does São Carlos Empreendimentos e Participações Carry?

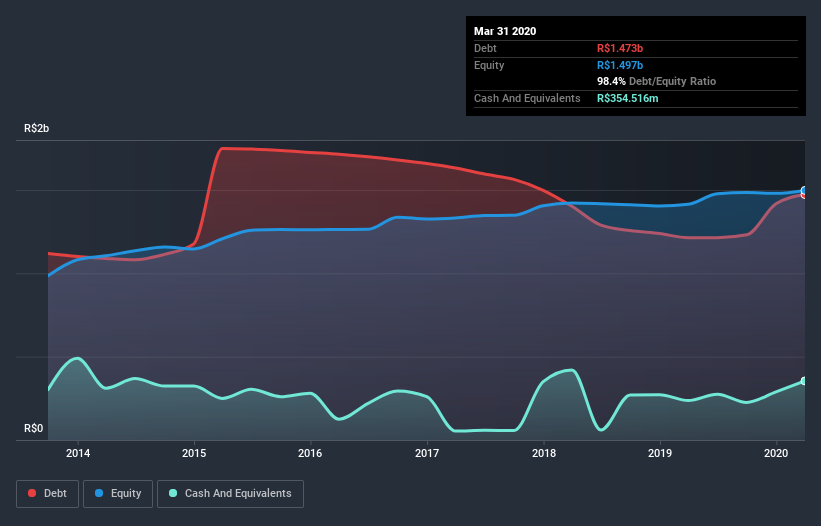

You can click the graphic below for the historical numbers, but it shows that as of March 2020 São Carlos Empreendimentos e Participações had R$1.47b of debt, an increase on R$1.21b, over one year. On the flip side, it has R$354.5m in cash leading to net debt of about R$1.12b.

How Strong Is São Carlos Empreendimentos e Participações's Balance Sheet?

We can see from the most recent balance sheet that São Carlos Empreendimentos e Participações had liabilities of R$192.0m falling due within a year, and liabilities of R$1.33b due beyond that. Offsetting these obligations, it had cash of R$354.5m as well as receivables valued at R$54.3m due within 12 months. So it has liabilities totalling R$1.1b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since São Carlos Empreendimentos e Participações has a market capitalization of R$2.21b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

São Carlos Empreendimentos e Participações's debt is 3.6 times its EBITDA, and its EBIT cover its interest expense 3.1 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, it should be some comfort for shareholders to recall that São Carlos Empreendimentos e Participações actually grew its EBIT by a hefty 111%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine São Carlos Empreendimentos e Participações's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, São Carlos Empreendimentos e Participações created free cash flow amounting to 15% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

São Carlos Empreendimentos e Participações's interest cover and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But the good news is it seems to be able to grow its EBIT with ease. Looking at all the angles mentioned above, it does seem to us that São Carlos Empreendimentos e Participações is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for São Carlos Empreendimentos e Participações (1 can't be ignored) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade São Carlos Empreendimentos e Participações, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:SCAR3

São Carlos Empreendimentos e Participações

São Carlos Empreendimentos e Participações S.A.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion