Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Rentokil Initial plc (LON:RTO) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Rentokil Initial

What Is Rentokil Initial's Net Debt?

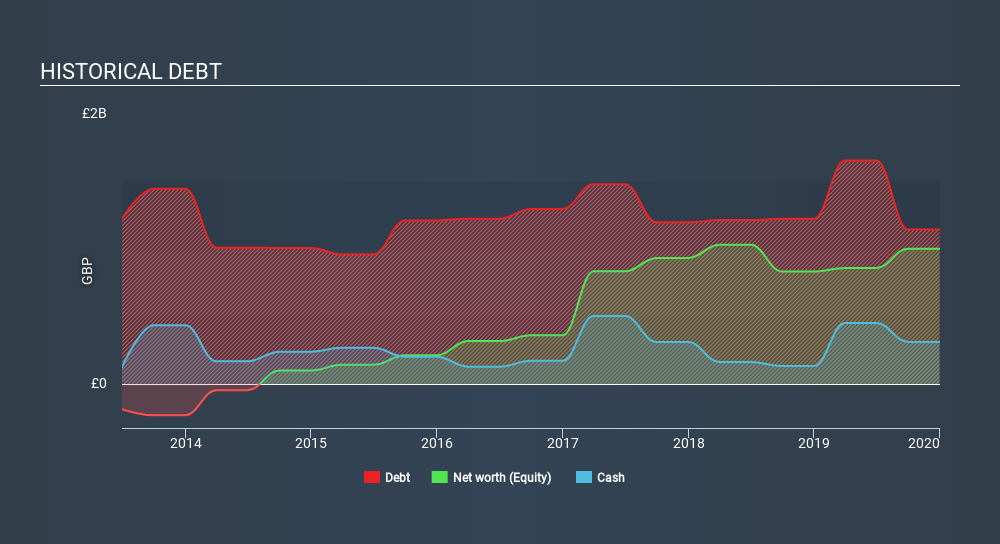

As you can see below, Rentokil Initial had UK£1.14b of debt at December 2019, down from UK£1.22b a year prior. However, it also had UK£311.4m in cash, and so its net debt is UK£832.5m.

A Look At Rentokil Initial's Liabilities

The latest balance sheet data shows that Rentokil Initial had liabilities of UK£915.8m due within a year, and liabilities of UK£1.48b falling due after that. Offsetting this, it had UK£311.4m in cash and UK£477.6m in receivables that were due within 12 months. So its liabilities total UK£1.60b more than the combination of its cash and short-term receivables.

Since publicly traded Rentokil Initial shares are worth a very impressive total of UK£8.85b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 1.7, Rentokil Initial uses debt artfully but responsibly. And the alluring interest cover (EBIT of 7.2 times interest expense) certainly does not do anything to dispel this impression. The good news is that Rentokil Initial has increased its EBIT by 3.7% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Rentokil Initial can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Rentokil Initial produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Rentokil Initial's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And its interest cover is good too. All these things considered, it appears that Rentokil Initial can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Rentokil Initial (1 is potentially serious!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About LSE:RTO

Rentokil Initial

Provides route-based services in North America, Europe, the United Kingdom, Asia, the Middle East, North Africa, Turkey, and Pacific.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives