Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Redrow plc (LON:RDW) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Redrow

What Is Redrow's Debt?

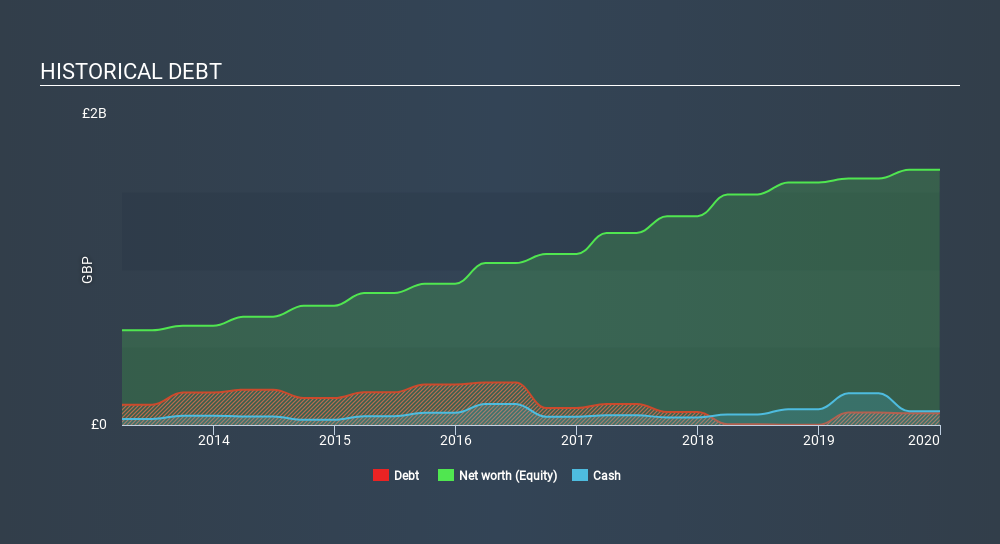

The image below, which you can click on for greater detail, shows that at December 2019 Redrow had debt of UK£75.0m, up from UK£1.00m in one year. However, it does have UK£89.0m in cash offsetting this, leading to net cash of UK£14.0m.

How Healthy Is Redrow's Balance Sheet?

According to the last reported balance sheet, Redrow had liabilities of UK£699.0m due within 12 months, and liabilities of UK£212.0m due beyond 12 months. Offsetting this, it had UK£89.0m in cash and UK£51.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£771.0m.

Redrow has a market capitalization of UK£2.91b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Redrow also has more cash than debt, so we're pretty confident it can manage its debt safely.

But the other side of the story is that Redrow saw its EBIT decline by 2.8% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Redrow's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Redrow has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, Redrow recorded free cash flow of 42% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

Although Redrow's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of UK£14.0m. So we are not troubled with Redrow's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Redrow that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:RDW

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives