Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that NRC Group ASA (OB:NRC) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for NRC Group

What Is NRC Group's Net Debt?

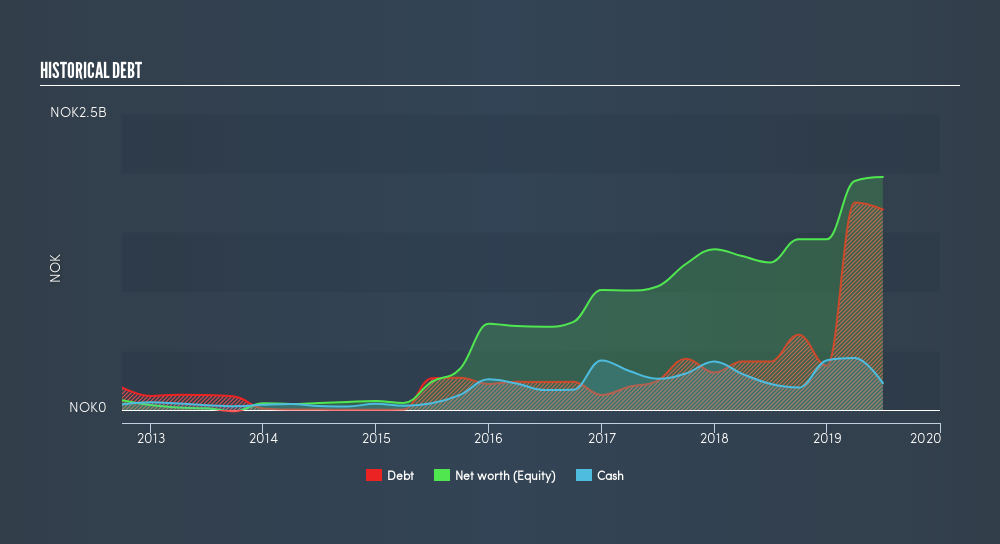

The image below, which you can click on for greater detail, shows that at June 2019 NRC Group had debt of kr1.69b, up from kr408.0m in one year. However, because it has a cash reserve of kr226.0m, its net debt is less, at about kr1.47b.

A Look At NRC Group's Liabilities

According to the last reported balance sheet, NRC Group had liabilities of kr2.45b due within 12 months, and liabilities of kr1.42b due beyond 12 months. On the other hand, it had cash of kr226.0m and kr1.59b worth of receivables due within a year. So it has liabilities totalling kr2.05b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of kr3.16b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if NRC Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year NRC Group managed to grow its revenue by 68%, to kr4.7b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly savour NRC Group's tasty revenue growth, its negative earnings before interest and tax (EBIT) leaves a bitter aftertaste. Indeed, it lost kr14m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of-kr122.0m. So in short it's a really risky stock. For riskier companies like NRC Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:NRC

NRC Group

Operates as a rail infrastructure company in Norway, Sweden, and Finland.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives