- Hong Kong

- /

- Entertainment

- /

- SEHK:2660

Is Now The Time To Put Zengame Technology Holding (HKG:2660) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Zengame Technology Holding (HKG:2660). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Zengame Technology Holding

Zengame Technology Holding's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, Zengame Technology Holding's EPS soared from CN¥0.13 to CN¥0.17, in just one year. That's a commendable gain of 26%.

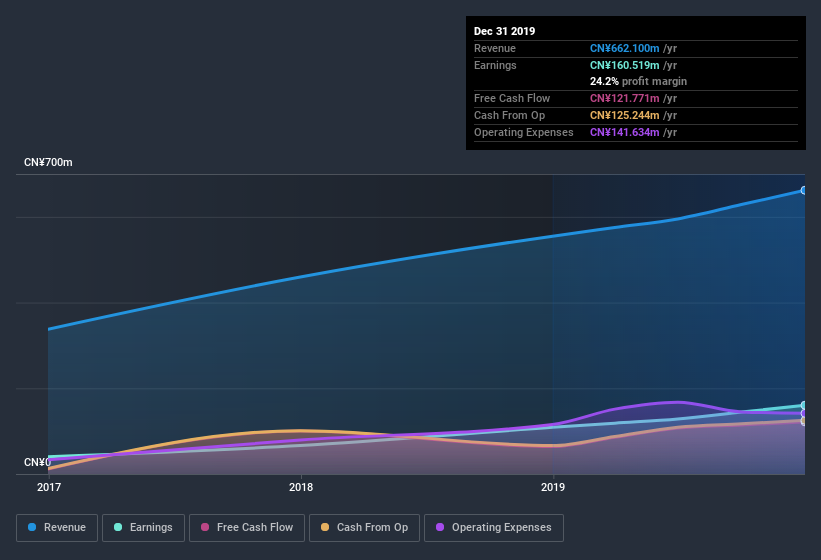

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Zengame Technology Holding shareholders can take confidence from the fact that EBIT margins are up from 23% to 27%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Zengame Technology Holding isn't a huge company, given its market capitalization of HK$1.3b. That makes it extra important to check on its balance sheet strength.

Are Zengame Technology Holding Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent CN¥10m buying Zengame Technology Holding shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Chairman of the Board & CEO, Sheng Ye, who made the biggest single acquisition, paying HK$5.0m for shares at about HK$0.56 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Zengame Technology Holding insiders own more than a third of the company. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have CN¥866m invested in the business, using the current share price. That's nothing to sneeze at!

Should You Add Zengame Technology Holding To Your Watchlist?

For growth investors like me, Zengame Technology Holding's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 3 warning signs for Zengame Technology Holding (1 shouldn't be ignored!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Zengame Technology Holding isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Zengame Technology Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zengame Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2660

Zengame Technology Holding

An investment holding company, develops and operates mobile games primarily in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives