Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like 7FIT (WSE:7FT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for 7FIT

How Quickly Is 7FIT Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years 7FIT grew its EPS by 9.3% per year. That's a good rate of growth, if it can be sustained.

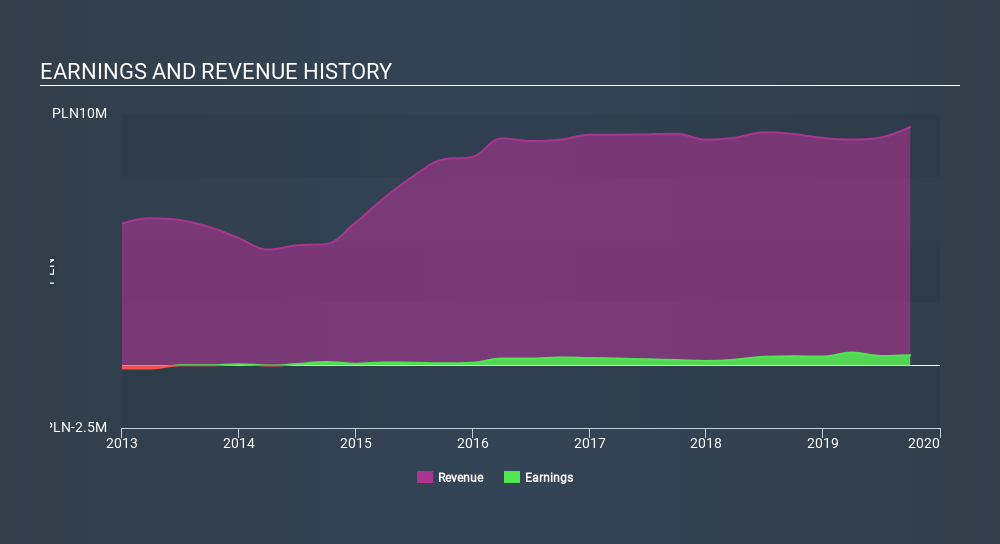

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). 7FIT maintained stable EBIT margins over the last year, all while growing revenue 3.1% to zł9.5m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

7FIT isn't a huge company, given its market capitalization of zł1.9m. That makes it extra important to check on its balance sheet strength.

Are 7FIT Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that 7FIT insiders own a significant number of shares certainly appeals to me. In fact, they own 73% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, 7FIT is a very small company, with a market cap of only zł1.9m. So despite a large proportional holding, insiders only have zł1.4m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is 7FIT Worth Keeping An Eye On?

As I already mentioned, 7FIT is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Of course, profit growth is one thing but it's even better if 7FIT is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:7FT

7FIT

Operates a network of nutrient stores in Poland, the Great Britain, Ireland, Germany, Spain, Denmark, Slovakia, and France.

Excellent balance sheet low.

Market Insights

Community Narratives