Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Nordson Corporation (NASDAQ:NDSN) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nordson

How Much Debt Does Nordson Carry?

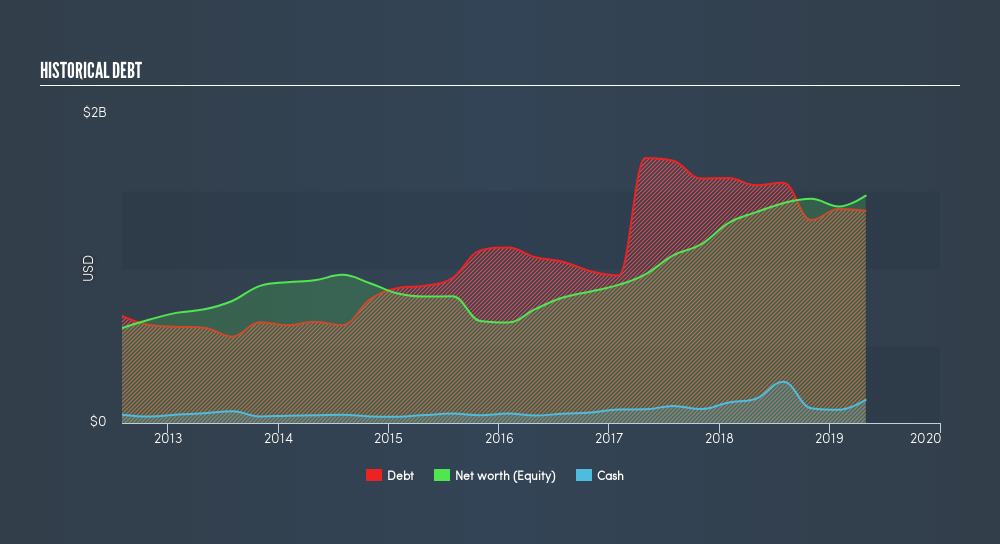

You can click the graphic below for the historical numbers, but it shows that Nordson had US$1.38b of debt in April 2019, down from US$1.54b, one year before However, because it has a cash reserve of US$149.2m, its net debt is less, at about US$1.23b.

How Healthy Is Nordson's Balance Sheet?

The latest balance sheet data shows that Nordson had liabilities of US$446.5m due within a year, and liabilities of US$1.56b falling due after that. Offsetting this, it had US$149.2m in cash and US$484.9m in receivables that were due within 12 months. So it has liabilities totalling US$1.37b more than its cash and near-term receivables, combined.

Given Nordson has a market capitalization of US$8.14b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Because it carries more debt than cash, we think it's worth watching Nordson's balance sheet over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a debt to EBITDA ratio of 2.13, Nordson uses debt artfully but responsibly. And the alluring interest cover (EBIT of 9.49 times interest expense) certainly does not do anything to dispel this impression. The bad news is that Nordson saw its EBIT decline by 11% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Nordson can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Nordson produced sturdy free cash flow equating to 71% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Nordson's conversion of EBIT to free cash flow was a real positive on this analysis, as was its interest cover. Having said that, its EBIT growth rate somewhat sensitizes us to potential future risks to the balance sheet. Considering this range of data points, we think Nordson is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Nordson insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives