Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Nippi,Incorporated (TYO:7932) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for NippiIncorporated

What Is NippiIncorporated's Net Debt?

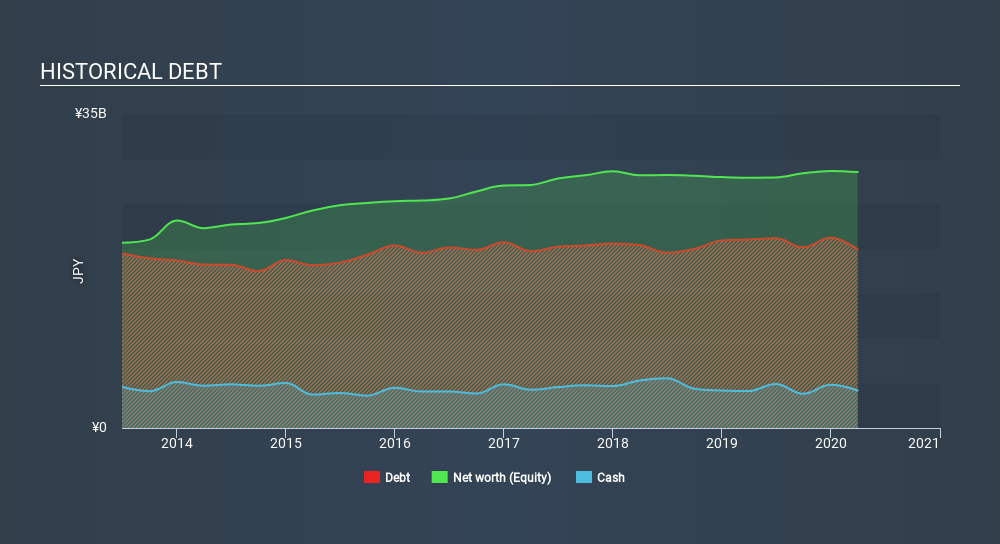

As you can see below, NippiIncorporated had JP¥19.9b of debt at March 2020, down from JP¥21.0b a year prior. However, it does have JP¥4.18b in cash offsetting this, leading to net debt of about JP¥15.7b.

How Healthy Is NippiIncorporated's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that NippiIncorporated had liabilities of JP¥20.8b due within 12 months and liabilities of JP¥18.3b due beyond that. Offsetting these obligations, it had cash of JP¥4.18b as well as receivables valued at JP¥8.41b due within 12 months. So its liabilities total JP¥26.5b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the JP¥10.1b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, NippiIncorporated would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

NippiIncorporated's net debt is 4.4 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 30.1 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Pleasingly, NippiIncorporated is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 123% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since NippiIncorporated will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, NippiIncorporated created free cash flow amounting to 15% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say NippiIncorporated's level of total liabilities was disappointing. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that NippiIncorporated's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with NippiIncorporated (including 2 which is shouldn't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSE:7932

NippiIncorporated

Manufactures and sells collagen casings, gelatin and collagen peptides, leather, cosmetics and health foods, functional polymers, and life science products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives