- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

Is National HealthCare (NYSEMKT:NHC) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, National HealthCare Corporation (NYSEMKT:NHC) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for National HealthCare

How Much Debt Does National HealthCare Carry?

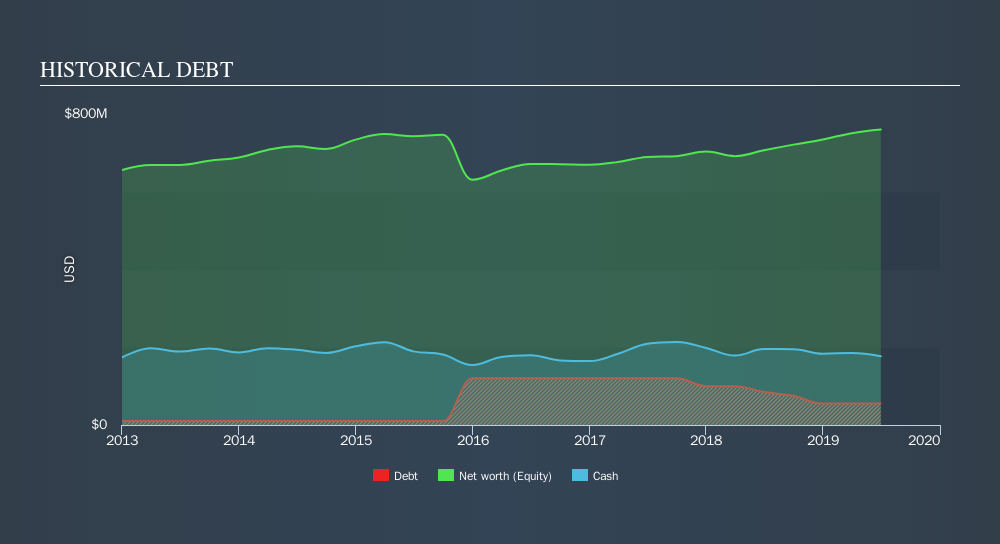

You can click the graphic below for the historical numbers, but it shows that National HealthCare had US$55.0m of debt in June 2019, down from US$109.9m, one year before. However, it does have US$176.8m in cash offsetting this, leading to net cash of US$121.8m.

A Look At National HealthCare's Liabilities

The latest balance sheet data shows that National HealthCare had liabilities of US$171.7m due within a year, and liabilities of US$382.7m falling due after that. On the other hand, it had cash of US$176.8m and US$98.9m worth of receivables due within a year. So its liabilities total US$278.7m more than the combination of its cash and short-term receivables.

National HealthCare has a market capitalization of US$1.23b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, National HealthCare also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, National HealthCare saw its EBIT drop by 4.8% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is National HealthCare's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. National HealthCare may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, National HealthCare recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing up

Although National HealthCare's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$121.8m. And it impressed us with free cash flow of US$60m, being 99% of its EBIT. So we don't think National HealthCare's use of debt is risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that National HealthCare insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives