MedAdvisor Limited (ASX:MDR) shareholders have seen the share price descend 14% over the month. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 106% compared to three years ago. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for MedAdvisor

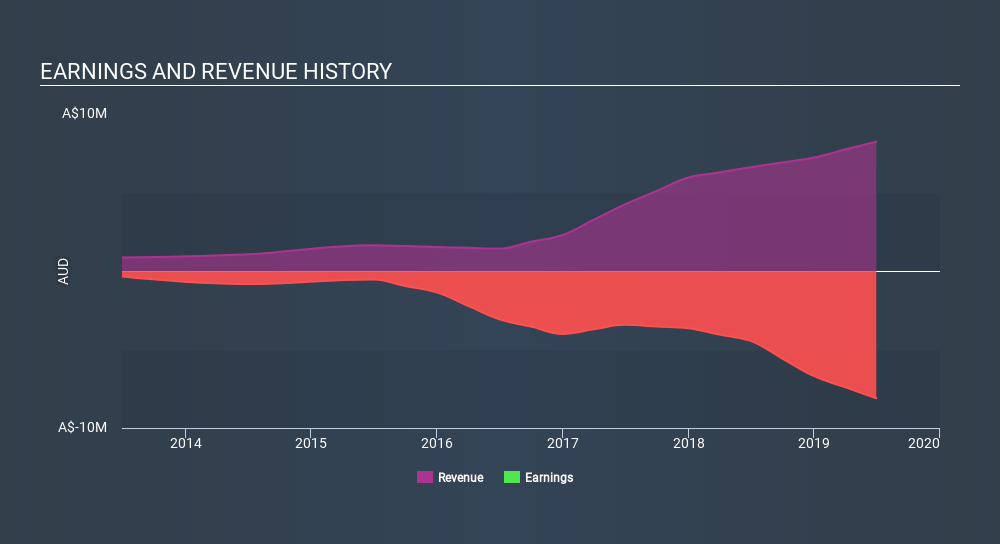

MedAdvisor wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years MedAdvisor has grown its revenue at 46% annually. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 27% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at MedAdvisor's financial health with this free report on its balance sheet.

A Different Perspective

Pleasingly, MedAdvisor's total shareholder return last year was 100%. So this year's TSR was actually better than the three-year TSR (annualized) of 27%. Given the track record of solid returns over varying time frames, it might be worth putting MedAdvisor on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that MedAdvisor is showing 6 warning signs in our investment analysis , and 2 of those are a bit concerning...

But note: MedAdvisor may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MDR

MedAdvisor

Provides pharmacy-driven patient engagement solutions in Australia, New Zealand, the United States, and the United Kingdom.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives