- United States

- /

- Trade Distributors

- /

- NasdaqGS:MGRC

Is McGrath RentCorp's (NASDAQ:MGRC) P/E Ratio Really That Good?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). To keep it practical, we'll show how McGrath RentCorp's (NASDAQ:MGRC) P/E ratio could help you assess the value on offer. McGrath RentCorp has a P/E ratio of 18.39, based on the last twelve months. That is equivalent to an earnings yield of about 5.4%.

View our latest analysis for McGrath RentCorp

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for McGrath RentCorp:

P/E of 18.39 = $66.1 ÷ $3.59 (Based on the trailing twelve months to June 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Does McGrath RentCorp's P/E Ratio Compare To Its Peers?

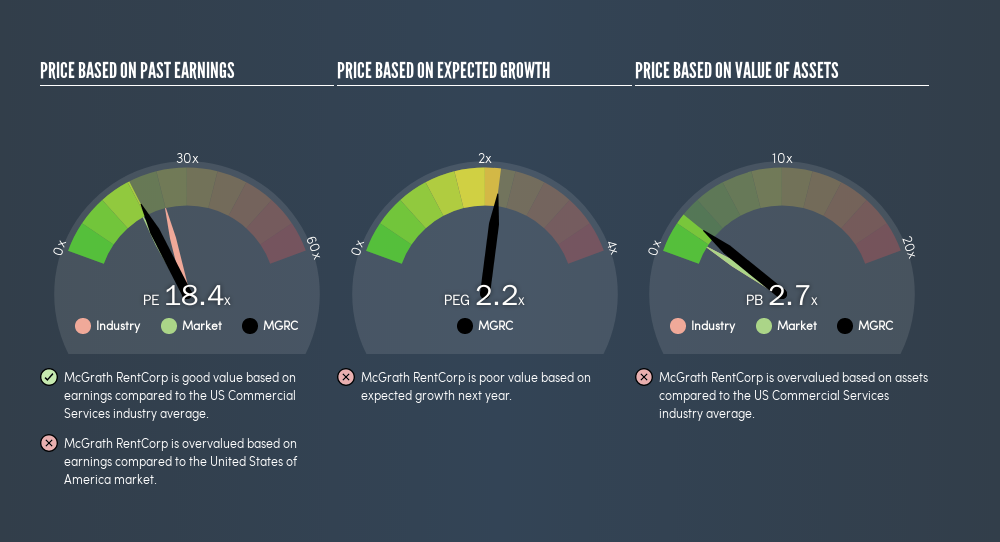

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. We can see in the image below that the average P/E (24) for companies in the commercial services industry is higher than McGrath RentCorp's P/E.

McGrath RentCorp's P/E tells us that market participants think it will not fare as well as its peers in the same industry.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

McGrath RentCorp shrunk earnings per share by 48% over the last year. But EPS is up 17% over the last 5 years.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. In other words, it does not consider any debt or cash that the company may have on the balance sheet. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

So What Does McGrath RentCorp's Balance Sheet Tell Us?

McGrath RentCorp's net debt is 19% of its market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Bottom Line On McGrath RentCorp's P/E Ratio

McGrath RentCorp has a P/E of 18.4. That's around the same as the average in the US market, which is 17.2. When you consider the lack of EPS growth last year (along with some debt), it seems the market is optimistic about the future for the business.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than McGrath RentCorp. So you may wish to see this free collection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MGRC

McGrath RentCorp

Operates as a business-to-business rental company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

Digital Ad Landscape Will Face Heightened Competition And Shifting Partnerships Ahead

SFM: Multi-Year Growth Plan Will Drive Renewed Momentum Despite Near-Term Challenges

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion