- United States

- /

- Real Estate

- /

- NYSEAM:NEN

Is It Smart To Buy New England Realty Associates Limited Partnership (NYSEMKT:NEN) Before It Goes Ex-Dividend?

Readers hoping to buy New England Realty Associates Limited Partnership (NYSEMKT:NEN) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 13th of September in order to receive the dividend, which the company will pay on the 30th of September.

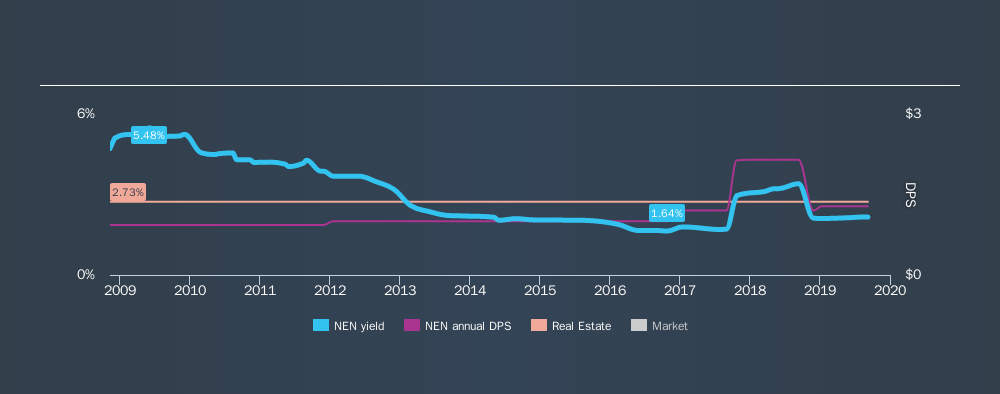

New England Realty Associates Limited Partnership's next dividend payment will be US$0.32 per share, and in the last 12 months, the company paid a total of US$1.28 per share. Calculating the last year's worth of payments shows that New England Realty Associates Limited Partnership has a trailing yield of 2.2% on the current share price of $59.305. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for New England Realty Associates Limited Partnership

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 84% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth We'd be worried about the risk of a drop in earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 18% of its free cash flow last year.

It's positive to see that New England Realty Associates Limited Partnership's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see New England Realty Associates Limited Partnership's earnings have been skyrocketing, up 24% per annum for the past five years. The company is paying out more than three-quarters of its earnings, but it is also generating strong earnings growth.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. New England Realty Associates Limited Partnership has delivered an average of 3.2% per year annual increase in its dividend, based on the past ten years of dividend payments. Earnings per share have been growing much quicker than dividends, potentially because New England Realty Associates Limited Partnership is keeping back more of its profits to grow the business.

Final Takeaway

Is New England Realty Associates Limited Partnership an attractive dividend stock, or better left on the shelf? We like New England Realty Associates Limited Partnership's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. Overall we think this is an attractive combination and worthy of further research.

Keen to explore more data on New England Realty Associates Limited Partnership's financial performance? Check out our visualisation of its historical revenue and earnings growth.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:NEN

New England Realty Associates Limited Partnership

Engages in acquiring, developing, holding for investment, operating, and selling of real estate properties in the United States.

Established dividend payer and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)