Martin Alistair Earp became the CEO of InvoCare Limited (ASX:IVC) in 2015. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for InvoCare

How Does Martin Alistair Earp's Compensation Compare With Similar Sized Companies?

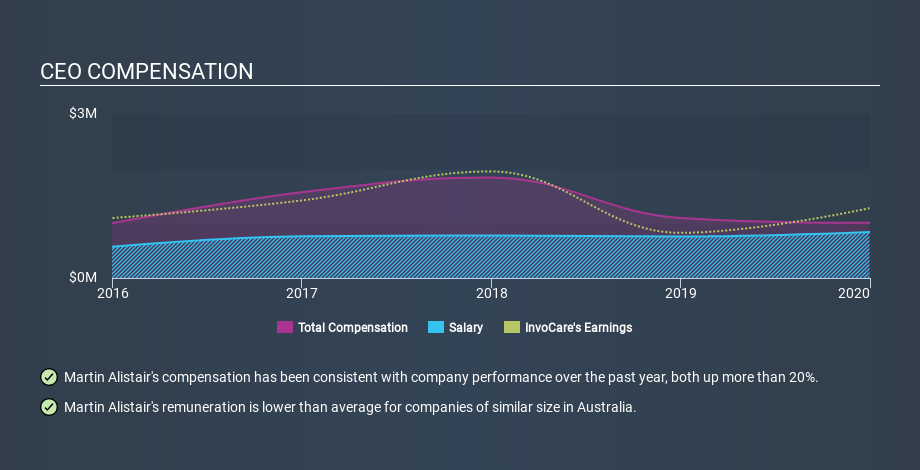

Our data indicates that InvoCare Limited is worth AU$1.5b, and total annual CEO compensation was reported as AU$1.0m for the year to December 2019. That's less than last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at AU$843k. We examined companies with market caps from AU$583m to AU$2.3b, and discovered that the median CEO total compensation of that group was AU$1.5m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of InvoCare. On a sector level, around 80% of total compensation represents salary and 20% is other remuneration. InvoCare is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion. You can see, below, how CEO compensation at InvoCare has changed over time.

Is InvoCare Limited Growing?

InvoCare Limited has reduced its earnings per share by an average of 15% a year, over the last three years (measured with a line of best fit). In the last year, its revenue is up 4.1%.

Unfortunately, earnings per share have trended lower over the last three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Shareholders might be interested in this free visualization of analyst forecasts.

Has InvoCare Limited Been A Good Investment?

Since shareholders would have lost about 17% over three years, some InvoCare Limited shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

It looks like InvoCare Limited pays its CEO less than similar sized companies.

The compensation paid to Martin Alistair Earp is lower than is usual at similar sized companies, but the eps growth is lacking, just like the returns (over three years). Considering all these factors, we'd stop short of saying the CEO pay is too high, but we don't think shareholders would want to see a pay rise before business performance improves. CEO compensation is an important area to keep your eyes on, but we've also identified 3 warning signs for InvoCare (1 doesn't sit too well with us!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:IVC

InvoCare

InvoCare Limited provides funeral, cemetery, crematoria, and related services in Australia, New Zealand, and Singapore.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives