David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies. IES Holdings, Inc. (NASDAQ:IESC) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for IES Holdings

What Is IES Holdings's Debt?

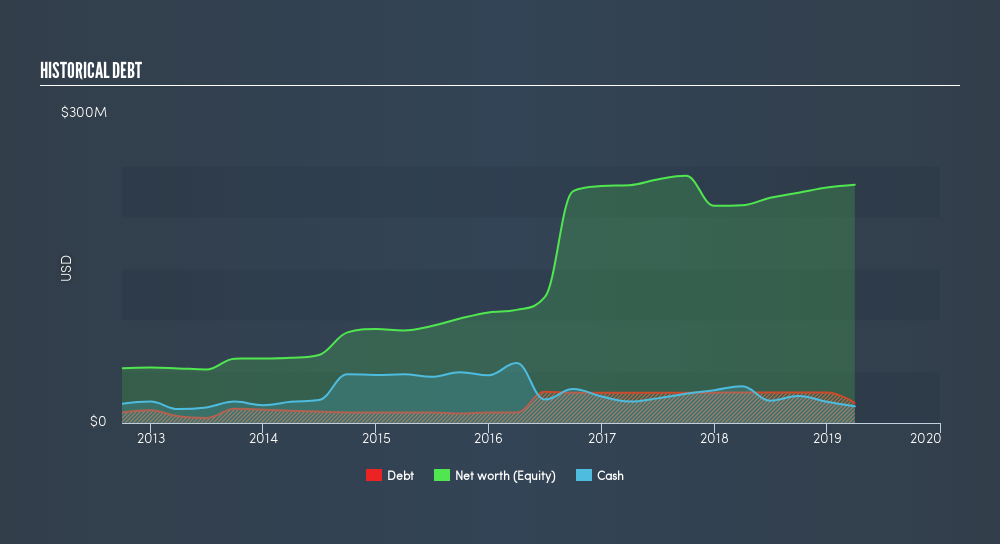

You can click the graphic below for the historical numbers, but it shows that IES Holdings had US$19.7m of debt in March 2019, down from US$29.6m, one year before However, it also had US$16.2m in cash, and so its net debt is US$3.51m.

How Healthy Is IES Holdings's Balance Sheet?

According to the last reported balance sheet, IES Holdings had liabilities of US$162.6m due within 12 months, and liabilities of US$23.3m due beyond 12 months. Offsetting this, it had US$16.2m in cash and US$212.1m in receivables that were due within 12 months. So it can boast US$42.3m more liquid assets than total liabilities.

This surplus suggests that IES Holdings has a conservative balance sheet, and could probably eliminate its debt without much difficulty. But either way, IES Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With debt at a measly 0.076 times EBITDA and EBIT covering interest a whopping 17.3 times, it's clear that IES Holdings is not a desperate borrower. Indeed relative to its earnings its debt load seems light as a feather. On top of that, IES Holdings grew its EBIT by 96% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is IES Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, IES Holdings recorded free cash flow of 43% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, IES Holdings's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Looking at the bigger picture, we think IES Holdings's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. Another factor that would give us confidence in IES Holdings would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:IESC

IES Holdings

Designs and installs integrated electrical and technology systems, and provides infrastructure products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives