- United States

- /

- Healthtech

- /

- OTCPK:HTGM.Q

Is HTG Molecular Diagnostics (NASDAQ:HTGM) Weighed On By Its Debt Load?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that HTG Molecular Diagnostics, Inc. (NASDAQ:HTGM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View 3 warning signs we detected for HTG Molecular Diagnostics

What Is HTG Molecular Diagnostics's Debt?

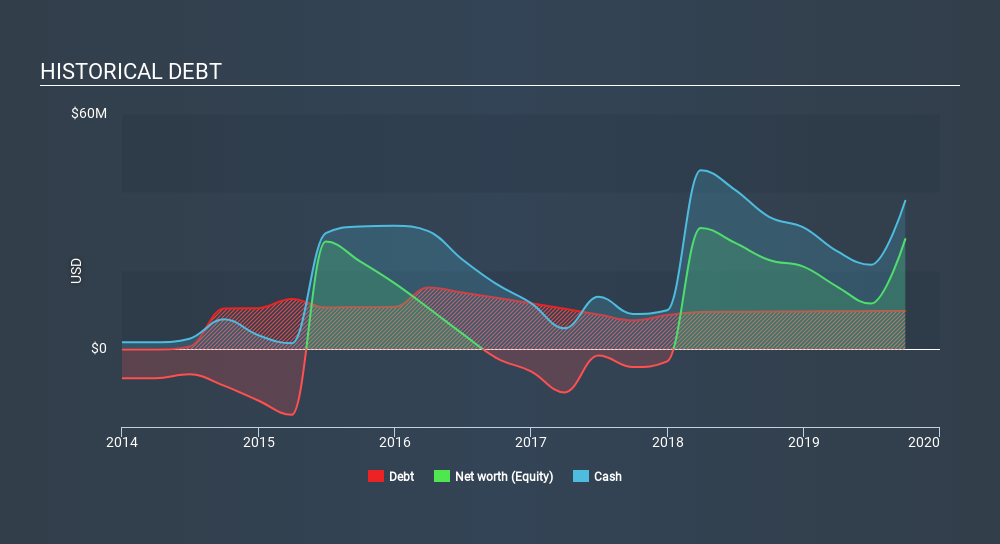

The image below, which you can click on for greater detail, shows that at September 2019 HTG Molecular Diagnostics had debt of US$9.81m, up from US$9.6 in one year. But on the other hand it also has US$37.9m in cash, leading to a US$28.1m net cash position.

A Look At HTG Molecular Diagnostics's Liabilities

The latest balance sheet data shows that HTG Molecular Diagnostics had liabilities of US$8.42m due within a year, and liabilities of US$14.4m falling due after that. Offsetting this, it had US$37.9m in cash and US$3.93m in receivables that were due within 12 months. So it can boast US$19.0m more liquid assets than total liabilities.

This luscious liquidity implies that HTG Molecular Diagnostics's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, HTG Molecular Diagnostics boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine HTG Molecular Diagnostics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year HTG Molecular Diagnostics wasn't profitable at an EBIT level, but managed to grow its revenue by 2.1%, to US$22m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is HTG Molecular Diagnostics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months HTG Molecular Diagnostics lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$16m and booked a US$17m accounting loss. However, it has net cash of US$28.1m, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for HTG Molecular Diagnostics which any shareholder or potential investor should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:HTGM.Q

HTG Molecular Diagnostics

A life sciences company, focuses on the precision medicine.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives