- United States

- /

- Packaging

- /

- NYSE:GEF

Is Greif, Inc.'s (NYSE:GEF) P/E Ratio Really That Good?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll show how you can use Greif, Inc.'s (NYSE:GEF) P/E ratio to inform your assessment of the investment opportunity. What is Greif's P/E ratio? Well, based on the last twelve months it is 11.67. That means that at current prices, buyers pay $11.67 for every $1 in trailing yearly profits.

Check out our latest analysis for Greif

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Greif:

P/E of 11.67 = USD41.40 ÷ USD3.55 (Based on the year to October 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each USD1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

Does Greif Have A Relatively High Or Low P/E For Its Industry?

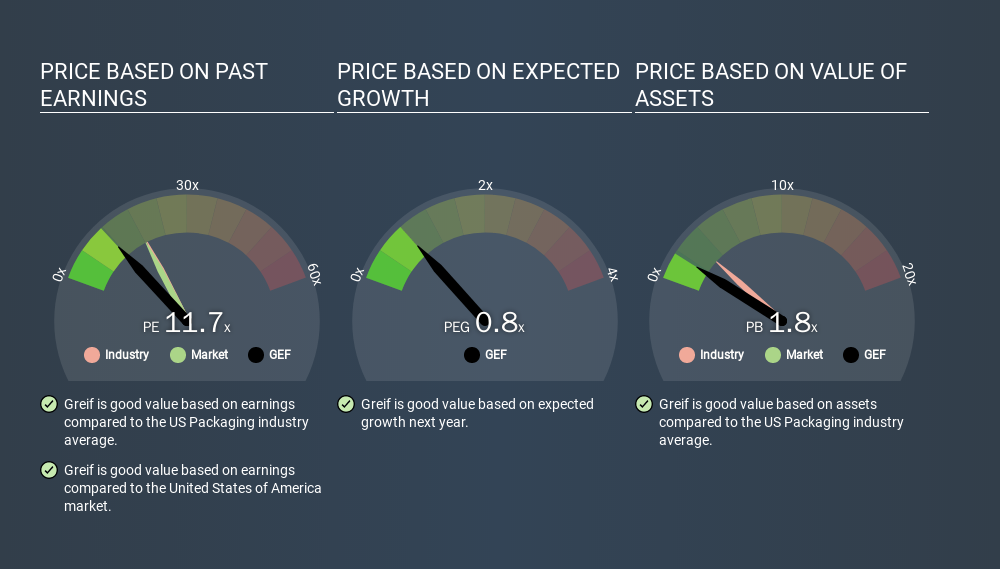

The P/E ratio essentially measures market expectations of a company. We can see in the image below that the average P/E (18.7) for companies in the packaging industry is higher than Greif's P/E.

This suggests that market participants think Greif will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Greif's earnings per share fell by 19% in the last twelve months. But EPS is up 13% over the last 5 years.

Remember: P/E Ratios Don't Consider The Balance Sheet

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Is Debt Impacting Greif's P/E?

Greif has net debt worth a very significant 126% of its market capitalization. This level of debt justifies a relatively low P/E, so remain cognizant of the debt, if you're comparing it to other stocks.

The Verdict On Greif's P/E Ratio

Greif trades on a P/E ratio of 11.7, which is below the US market average of 18.2. Given meaningful debt, and a lack of recent growth, the market looks to be extrapolating this recent performance; reflecting low expectations for the future.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Greif. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GEF

Greif

Produces and sells industrial packaging products and services worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Very Bullish

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.