- Hong Kong

- /

- Entertainment

- /

- SEHK:1909

Is Fire Rock Holdings Limited (HKG:1909) Excessively Paying Its CEO?

In 2015, Yong Huang was appointed CEO of Fire Rock Holdings Limited (HKG:1909). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Fire Rock Holdings

How Does Yong Huang's Compensation Compare With Similar Sized Companies?

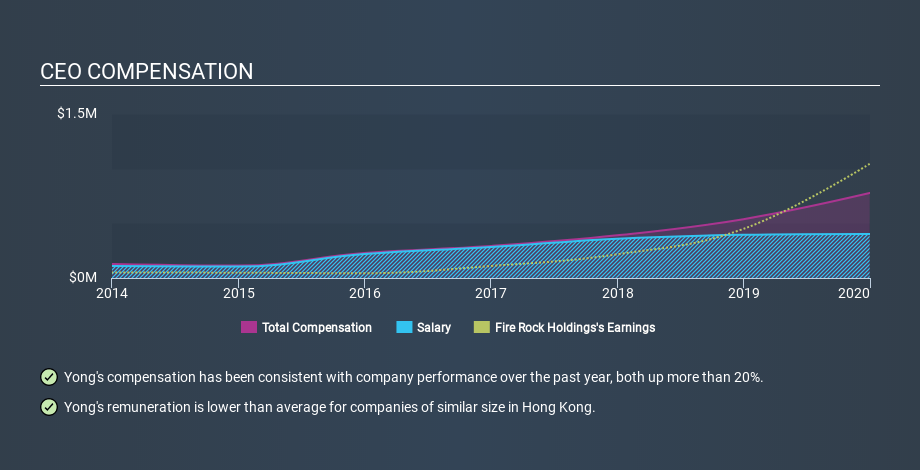

Our data indicates that Fire Rock Holdings Limited is worth HK$1.3b, and total annual CEO compensation was reported as CN¥777k for the year to December 2019. That's a notable increase of 44% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CN¥403k. We examined companies with market caps from CN¥709m to CN¥2.8b, and discovered that the median CEO total compensation of that group was CN¥2.0m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Fire Rock Holdings stands. Talking in terms of the sector, salary represented approximately 82% of total compensation out of all the companies we analysed, while other remuneration made up 18% of the pie. It's interesting to note that Fire Rock Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry.

Most shareholders would consider it a positive that Yong Huang takes less total compensation than the CEOs of most similar size companies, leaving more for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion. The graphic below shows how CEO compensation at Fire Rock Holdings has changed from year to year.

Is Fire Rock Holdings Limited Growing?

On average over the last three years, Fire Rock Holdings Limited has seen earnings per share (EPS) move in a favourable direction by 66% each year (using a line of best fit). It achieved revenue growth of 89% over the last year.

This demonstrates that the company has been improving recently. A good result. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Fire Rock Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Fire Rock Holdings Limited for providing a total return of 160% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

It looks like Fire Rock Holdings Limited pays its CEO less than similar sized companies.

Since the business is growing, many would argue this suggests the pay is modest. And given most shareholders are probably very happy with recent returns, you might even think that Yong Huang deserves a raise! It is relatively rare to see a modestly paid CEO when performance is so impressive. But it is even better if company insiders are also buying shares with their own money. Moving away from CEO compensation for the moment, we've identified 1 warning sign for Fire Rock Holdings that you should be aware of before investing.

Important note: Fire Rock Holdings may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1909

Fire Rock Holdings

An investment holding company, develops mobile games in the Asia Pacific.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.